See why 4thWay now accepts ethical ads.

Funding Circle Lending Strategy

This is the second article in 4thWay's Lending Strategy series that focuses on strategy for a single P2P lending company, and I've decided to go with another big one: Funding Circle.

As you will see reading the various strategies and techniques below, you can get up to 12.5% after fees and bad debts at very low risk!

Funding Circle is for lending to businesses and it's the second oldest peer-to-peer lending website in the UK, being over four-and-a-half years old.

Funding Circle has a fantastic record. No one who has lent to at least 100 borrowers and no more than 1% of their money to any one borrower has lost money. At least that was the case up to 18 August 2014. Funding Circle hasn't updated us since then.

The average interest that lenders have earned has been 6.3% after fees and bad debts.

Yet Funding Circle is an interesting one where most people are taking on more risk than they need to in order to get that rate, and quite a few people are earning less than they should.

Funding Circle lending strategy: five borrower grades

Funding Circle has five borrower grades. It labels its different grades like this:

A+: “very low risk”.

A: “low risk”.

B: “below average risk”.

C: “average risk”.

C-: “above average risk”.

Those are Funding Circle's own words. You have to remember that A+ at one P2P lending company is not the same as A+ elsewhere. That goes for the other grades too. These businesses all have their own standards – and for some using the word “standards” is going to be a bit generous.

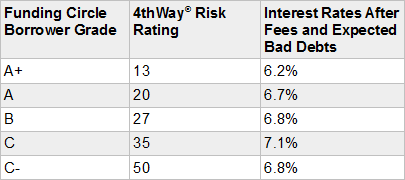

That's why the 4thWay® Risk Ratings come in handy, since they are a consistent grading structure:

Funding Circle risks and interest rates

A 4thWay® Risk Rating of 8 or less is as low risk as savings accounts. (No P2P lending company has a 4thWay® Risk Rating that low.) So by 4thWay's calculated score the A+ loans are very low risk, which supports Funding Circle's own label for A+: “very low risk”.

50 is currently the highest risk that 4thWay® has listed on its website, and this award goes to Funding Circle's C- loans, although the top rating is going to get a lot higher as 4thWay® risk rates more of the P2P lending companies.

Only lend higher up the risk scale when its justifiable

As you see in the right-hand column in the above table, the estimated interest you'll earn on A loans, at time of writing, only nudges up a little from A+.

Perhaps it's enough for the extra risk. But what's really astounding is that Funding Circle currently doesn't expect you to earn any more after bad debts and fees if you go up the risk scale from A to B, C and C- loans, because all of the grades A to C- are expected to earn you around 6.7% to 7.1%. That's just 0.4 percentage points of difference between them.

That doesn't make any sense to any of us here at 4thWay®. Why on Earth would you lend your money at higher risk if you don't really expect to get a better overall return? But that's what Funding Circle lenders are doing.

So I think that, at the B to C- grades, lenders are currently offering to lend at rates that are too low, on average.

Looking at the record of actual bad debts, it's very possible that Funding Circle is overestimating what average bad debts will be – at least during good economic times.

But if Funding Circle thinks it's sensible to do that then I personally don't want to take the chance that it's being too cautious, and I want to respect those figures. (If it appeared likely to be underestimating that would be a different matter.)

Funding Circle's auto-bid facility can be useful

Auto-bid is a very useful tool for people with little spare time. It's also good for people with no inclination to manage their investments personally, but I don't think that includes anyone who's read this far!

For starters, auto-bid makes your strategy easy. You don't have to select loans yourself.

But you also don't give up all your control. In particular, you can choose to just lend to borrower grades you specify. So you can avoid lending at any grades where the expected returns currently appear to be too low.

Auto-bid, not auto-pilot!

You can't just set on auto-bid and leave it though. There will be times when too many lenders are competing rates down and the rates are just too low for the risks involved. As we might well be seeing now at the higher risk grades.

You also have to keep an eye on how interest rates currently compare elsewhere.

Funding Circle's A+ loans are paying roughly the same as low-risk P2P lending companies RateSetter and Lending Works, and yet these two companies also have fat bad-debt provision funds set aside to cover any losses. Lending Works has been shrinking its pot somewhat, but it also has insurance to cover losses from borrowers who can't pay due to accident and unemployment.

That said, so long as the interest rates are reasonably comparable Funding Circle's A+ loans will be a good way to spread your risk across a few different P2P lending companies.

Lowering your risks

Switch off auto-bid and you can select loans yourself. For those of you with the time to do so, you have a pretty good advantage when it comes to lowering your risks.

Auto-bid buys loan parts for you from other lenders who want to leave. The thing is, sometimes other lenders want to leave because they've seen their borrower has made late payments or has had its borrower grade downgraded by Funding Circle. Both are significant signs that the loan might turn bad.

If you're on auto-bid, you can't look into the loan history and avoid having your money put into such loans automatically.

In addition, some borrowers have more than one loan on Funding Circle. And some have more than one across different P2P lending websites! So it could pay to ensure you're not lending too much money to one borrower across multiple loans.

Boosting your interest

You can also boost the interest you earn considerably by switching off auto-bid.

Unfortunately, Neil pipped me to the post just last week to write about how you can earn 7% to 12.5% after fees and expected bad debts just by lending to A+ borrowers.

You don't even have to bid more than average to get interest rates up to around 10%, since about a quarter of loans, at least recently, have above average rates compared to the rest.

But to get more like 12.5% in some loans you need to also bid higher.

Read more on that in Neil's article: Low Risk, Market Beating P2P Lending Opportunities.

Selecting loans for higher interest and lower risk

4thWay® research has found that expansion/growth capital loans on Funding Circle are less likely to go bad, yet they currently they earn you virtually the same interest rate after lending fees. After deducting actual bad debts, expansion/growth capital loans are likely to be paying you more interest than working capital loans.

Read more on that in Funding Circle Expansion Loans Are Lower Risk.

Funding Circle property loans

Funding Circle also does loans secured against property and there are a good number of them, so you can look for those paying good or above average interest while also lending considerably less than the property is valued at.

Neil, the swine, beat me to writing about this in that same article: Low Risk, Market Beating P2P Lending Opportunities.

I'd like to add that developer property loans – which are fairly common on Funding Circle – can be a bit complicated in that there can be many tranches of loans and lots of different buildings going up with the same borrower, so you have to be clear you understand what's going on and what the total risk is going to be.

And you need to be clear whether the loan-to-value is based on the existing land and buildings or on what the property is expected to be worth afterwards, which adds some extra uncertainty.

One more thing: these loans often come with up to 2% cashback (usually 0.5% or 1% though). And that's paid up front, so it's risk free and you can lend it right away to earn even more interest off of it. However, if you're using auto-bid, you'll find some of your money put into property loans offering no cashback, even though the ones with cashback don't really look any more risky.

Buying second hand

You can buy loan parts for existing loans from other lenders or you can sell them.

Sometimes you will see loan parts being offered at a discount. This means that someone might have lent £100 and is willing to accept just £98 off you in order to get out. Your borrower will then repay you £100 plus any interest that is due on it.

This doesn't happen all that often. The main reason is probably that lenders have been unwilling to sell at a discount. Understandable. But also some lenders – probably businesses mostly – are using software programs they develop to see these loans quickly and buy up the loan parts before any humans can do so.

But it does happen sometimes. For example, in recent times there have been more large property loans than the bots can handle.

Watch out: someone might be selling at a discount in an attempt to get out quickly due to the borrower missing loan repayments. That is a fair warning sign that the loan might go bad at some point. Funding Circle leaves a note on the record if there have been any missed loan repayments lasting several weeks, but it doesn't always make notes if those missed payments have been less than two weeks.

16% annual return with no risk!

Neil didn't spot the big one: a potential to earn an annualised rate of 16% per year.

Unfortunately, you can't get this very often and, when it happens, it might only last a month. So you can't expect to average 16% per year across all your Funding Circle lending, but you could nudge up your overall rate.

Here's what it is: some property loans pay 2% cashback. If you spot such an opportunity, you can take the 2% cashback and sell your loan part quickly at up to a 0.5% discount. You will also pay 0.25% to sell your loan part. Your remaining profit is 1.25%. Assuming a turnaround time of around four weeks – from placing your bid at auction to selling your loan part – that's 16% annual interest.

If only you could flip loans like this all year!

One potential downside is that lenders are slowly catching on to this technique. Sometimes you find that so many other lenders are selling their loan parts that you're unable to get rid of yours like you wanted to.

So overall, the tried-and-tested strategy of holding on to good investments for their duration might give you less of a headache.

Making a quick profit

Another technique you might try to boost your overall return is to look for second-hand loan parts selling at a big discount. Buy them, and then selling for a smaller discount or for no discount at all.

If you have bought a loan part from a loan that has been downgraded (e.g. A to B) , however, you might find the loan is not easy to sell.

So check the payment history before you bid.

Selling loan parts

There's evidence that it is easier to sell loan parts with no discount on Funding Circle. If you sell them at their original value (“par”) then lenders using “auto-bid” will automatically take part. At a discount, they get excluded.

Funding Circle auto-bidders will also take part even if the loan has been downgraded, provided they have specified that they will take loan parts from that borrower grade.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.