See why 4thWay now accepts ethical ads.

Are Bad Debt Forecasts Misleading?

Forecasts might not be the best way to decide whether to lend through a particular P2P lending website, but there are plenty of other ways to do so.

UK Bond Network, a P2P lending website, recently sent 4thWay® enough data to get listed in its comparison tables.

In doing so, it didn't provide any forecasts of its bad debts. Here's what it wrote instead:

“We do not believe it is fair or correct to provide investors with expected default or loss figures. We do not have enough data to predict this accurately.

“However as we expect our bond issuance will grow exponentially, as most other platforms in the P2P sector have, we do not intend to ever publish forecasts.

“We have so far had zero defaults, and will continue to be open about our historical figures, However by predicting defaults and losses when one knows an investment's [interest rate] you are effectively predicting what an investors returns will be. We are not comfortable with this.”

They've got a point!

You might think that's a cop out, but the fact is that forecasts are incredibly misleading. Personally, I couldn't agree more with them.

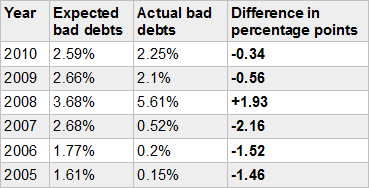

As an example, look at forecasts compared to the actual results for Zopa in its first six years:

Zopa bad debts versus forecasts

The bad-debt rates above are based on the year of loan issue.

Thankfully, most of Zopa‘s forecasts were far too high and bad debts were considerably lower than the oldest P2P lending website in the world originally thought. (That's why the differences in the table are almost all negative.)

So if you were dissuaded from lending in Zopa because of its forecasts, you were missing a trick.

That's the point: it's great that it has considerably beaten its forecasts but it's not as useful as an accurate forecast.

For the record, Zopa hasn't yet proved any more accurate at forecasting since 2010, although thankfully it is still forecasting far too high. It has averaged just 0.25% annual bad debts over the past five years.

I haven't deliberately selected Zopa because it's the worst at forecasting. There are a lot worse. I think that if you look at the record of any P2P lending website you can expect it to be seriously wrong, one way or the other.

So far, forecasts have mostly been much too high, probably because many are sensibly worried about upsetting our expectations. But we can't assume this will always be the case. It won't be.

Precision is destined to fail

If you look at forecasts for any other kind of investment, or of the economy, interest rates, house prices – anything – you'll see that the future is so uncertain that we can't put it in a forecast.

So even if a P2P lending website is trying to forecast as accurately as possible, with no buffer to set our expectations lower, we can still expect its forecasts to be terribly inaccurate, particularly when we most need them to be accurate!

Even if a P2P lending website had decades of results and completed hundreds of thousands of loans, the actual results will likely be either noticeably better or worse. These companies won't know what will happen to the economy next year any more than we do. Or professional economists do.

What can we do instead?

That doesn't mean we're helpless. Many P2P lending websites still provide us with an awful lot of information. That won't tell us what the actual bad-debt rates will be. But it can tell us whether we've got a good chance of getting a satisfactory return over the medium run, even if there's a nasty recession in the middle.

For example, if a P2P lending company sets clear, stringent criteria for borrowers, such as providing property as security (see sidebox, right) that is valued at a considerably higher price than the size of the loan.

a P2P lending company sets clear, stringent criteria for borrowers, such as providing property as security (see sidebox, right) that is valued at a considerably higher price than the size of the loan.

Here's another example: actual bad debts – as opposed to forecast bad debts – tell us a great deal about a P2P lending website.

It doesn't tell us what future bad debts will be, but if previous bad debts have been very low over thousands of loans, it can be a strong sign that the future will not be horrendous even during a bad economy.

We can also dig around to see if the P2P lending website is now accepting a far higher proportion of loans than it used to.

That can be a strong signal that the P2P company is lowering its standards, so we should probably stay away until we see how it does over the next few years compared to its closest competitors.

These are the sorts of signs 4thWay® routinely digs around for and we let you know immediately about any potential trouble signs if you sign up to our newsletter (which you can do below).

What if a P2P lending website is brand new?

If a P2P lending website is brand new, we should still not be too swayed by expected bad debts.

Look to how the company assesses borrowers, what its standards are and how much experience its key people have, before taking its forecast bad-debt figures – with a huge pinch of salt.

Above all else, good investing is about understanding the risks and containing the risks. If you have any doubts at all – any! – then don't lend your money.

Read more: How To Use The Bad-Debt Rate.

Our service is free to you. We don't receive commission or fees from the above-mentioned companies. We receive compensation from some other P2P lending companies when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. This doesn't affect our editorial independence. Read How we earn money fairly with your help.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.