This article is updated regularly. Last updated on 20 July 2015.

Funding Circle is currently returning cashback to lenders on loans secured against property.

There are currently four loans paying up to a record 10% interest and 2% cashback that Funding Circle grades as A+. (Scroll down to see them.)

That's 8.4% interest after fees and average expected bad debts – plus 2% cashback on top! Prior to this week, the highest rate available was 9% for these loans.

Review them below as soon as you can, because it's first-come, first-served, so you can't steal your way in at the end of the auction period by bidding a lower interest rate and under-cutting another lender.

And loans paying cashback tend to fill up fast!

Double Safety

Funding Circle's top borrower grade of A+ has remarkably low bad debts.

Barely a dozen A+ loans out of more than 1,000 have gone bad since Funding Circle started over four-and-a-half years ago. Even allowing for Funding Circle downgrading some loans (which could be a warning sign for you to sell your loan parts) this is still an excellent record.

Plus, Funding Circle property loans have an incredible record too: no Funding Circle property loans at any borrower grade have gone bad out of £45 million-worth of loans so far.

Combine the two – A+ and property – and you've got an incredibly winning combination!

Plus, you can get interest rates that beat RateSetter, Zopa and Lending Works*, even before you take the cashback into account. (See the latest Safest Peer-to-Peer Rates.)

I like these loans! Still, these are development loans, which could be riskier than, say, Landbay‘s* buy-to-let loans, especially during a downturn in the market. So you need to compensate for that by making sure the borrowers are experienced and that the amount the developers need to complete the project is considerably less than the expected sale value at the end.

And you must make sure you just put a small portion of your money in each one, as usual. Always spread your money around.

The Funding Circle property cashback loans are first come-first served, so you can't steal your way in at the end of the auction period by bidding a lower interest rate and under-cutting another lender. You need to get in early.

Funding Circle property loan: development in Islington

- A+ loan for 12 months.

- A record 10% fixed interest, which is 8.4% after Funding Circle fees and estimated bad debt.

- Cashback of 2% on top.

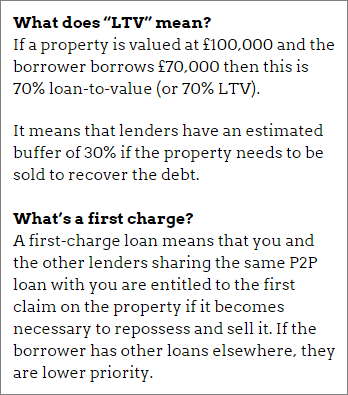

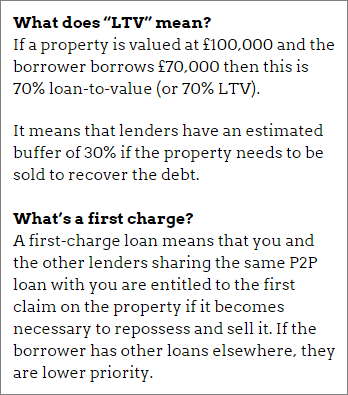

- 69% LTV mortgage

with a first charge. (See sidebox for definitions of “LTV” and “first charge”.)

with a first charge. (See sidebox for definitions of “LTV” and “first charge”.)

- Interest repaid monthly; your initial loan is repaid at the end.

- As of now, £200,000 of this £400,000 loan has already been funded.

- The total development on the site is expected to be valued at £1.75 million and total development costs are £1.4 million.

- The developers have contributed £316,000 of their own money.

- Experience: the only details we have is that “We have been undertaking renovation and new builds since 2004.”

Residential development in Richmond

- A+ loan for just 9 months.

- 7.5% fixed interest, which is 5.9% after Funding Circle fees and estimated bad debt.

- Cashback of 2% on top.

- 58% LTV mortgage with a first charge. (See sidebox.)

- Interest repaid monthly; your initial loan is repaid at the end.

- As of now, £144,000 of this £250,000 loan has already been funded.

- The total development on the site is expected to be valued at £3 million and total development costs are £700,000.

- The developers have contributed a whopping £1.6 million of their own money.

- Experience: the developers do not state the number of projects they have completed, but claim to have had experience since 2002.

Residential development in London

- A+ loan for 17 months.

- 8% fixed interest, which is 6.4% after Funding Circle fees and estimated bad debt.

- Cashback of 2% on top.

- 69% LTV mortgage with a first charge. (See sidebox, above right.)

- Interest repaid monthly; your initial loan is repaid at the end.

- As of now, £66,000 of this £300,000 loan has already been funded.

- The total development on the site is expected to be valued at £3.25 million and total development costs are £2.42m.

- The developers have contributed £400,000 of their own money.

- Experience: worked for KnightFrank, Savills and DTZ; has completed eight own projects since 2011.

Residential development in Surrey

- A+ loan for 18 months.

- 8% fixed interest, which is 6.4% after Funding Circle fees and estimated bad debt.

- Cashback of 2% on top.

- 55% LTV mortgage with a first charge. (See sidebox, above right.)

- Interest repaid monthly; your initial loan is repaid at the end.

- As of now, £6,000 of this £135,000 loan has already been funded.

- The total development on the site is expected to be valued at £5.2 million and total development costs are £3.73m.

- The developers have contributed a whopping £1.29m of their own money.

- Experience: the developers do not state the number of projects they have completed, but claim to have had experience since 2002.

About Funding Circle Property Cashback

Funding Circle property cashback loans are development loans. The loan-to-values are usually based on the final estimated value after the development is completed. This could add some more to your risks, e.g. if development costs are higher than expected or the sale price isn't as expected, so it's another reason to go for loans with lower LTVs. (See sidebox, above right, about “LTVs”.)

You should also try to ascertain that the developers have lots of prior experience and successfully completed projects.

You should never rush all your money into a loan – or any other investment – merely because of cashback. It's important that you spread your money across lots of loans, although it's fine to take several months in order to do so.

We think 100 loans is a reasonable spread to build towards if you're focusing on low risk loans like Funding Circle's A+ loans, although you can spread across other P2P lending websites as well. You could lend in fewer of these loans, provided you also spread your money across other loans or investments elsewhere to spread your risks.

Funding Circle property cashback is paid up front, so you're able to re-lend it for even more interest right away. This makes 1% of cashback more valuable than 1% extra in interest over shorter lending periods.

The other advantage is that it can't then be taken away from you by the loan going bad.

One downside to these loans at the moment is that there currently aren't always enough lenders to fill them within their usual seven-day deadline. So bidding is sometimes extended for up to another week.

However, the loss of interest from a bidding extension is tiny and that's not a good reason to rush off and lend in a higher-risk loan!

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Landbay, Lending Works and RateSetter, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.

with a first charge. (See sidebox for definitions of “LTV” and “first charge”.)

with a first charge. (See sidebox for definitions of “LTV” and “first charge”.)