See why 4thWay now accepts ethical ads.

How Does Peer-to-Peer Lending Tax Work?

When you earn money through peer-to-peer lending there are huge tax breaks available to you. For most people there's an automatic tax break on all P2P lending accounts.

You can also open specific peer-to-peer lending accounts, called IFISAs, which are always free of income tax and capital gains tax.

The online guidance on peer-to-peer lending tax that is available from HMRC is fragmented across lots of web pages in different parts of the gov.uk website and the information there isn't quite complete.

So we've taken all the published guidance from HMRC, and we've added plenty of research from consulting directly with tax advisors, HMRC and the P2P companies themselves. We also found Standard Life, the insurer and pension provider, to be useful, as well as speaking to SIPPclub.

This is currently up-to-date to 2025.

Key P2P tax rules in bullets

- Most people pay no income tax, because peer-to-peer lending is included in the “personal savings allowance”. That’s £1,000 tax-free interest for basic-rate taxpayers and £500 for higher-rate payers.

- As a result, basic-rate taxpayers will usually need to lend around £10,000-£20,000 before being charged taxes and higher-rate payers £5,000-£10,000.

- Most people don't have to declare P2P earnings to HM Revenue & Customs.

- You pay tax at your own income-tax rate on any interest earned that is taxable.

- You get additional tax breaks if you earn less than £17,570 per year.

- Bad debts are tax deductible.

- Everyone can lend tax-free through IFISAs, which means completely tax-free lending usually at the same cost as ordinary P2P lending accounts. (Read The Peer-To-Peer IFISA Guide.)

- Pension lending is completely free of tax, but it’s only currently suitable for people with a lot of money to lend due to the high pension costs.

- You're not likely to pay capital gains tax. But, if you invest a huge amount of money, it's possible that you will do so if you regularly buy and sell existing loans for profit outside of IFISAs or pensions.

How much P2P interest can I earn before paying taxes?

Basic-rate taxpayers

Through the personal savings allowance, basic-rate taxpayers are allowed to earn interest of £1,000 tax free from all their savings accounts and peer-to-peer lending accounts combined.

Any tax-free interest you earn in an IFISA does not eat into your personal savings allowance.

This means that, for basic-rate payers, you shouldn't usually expect to pay tax on any of your savings and P2P earnings until your pot size has grown larger than £10,000 to £20,000, depending on the interest rates. For example, if you earn 8% interest you'll need to be lending over £12,500 before using up your personal savings allowance.

All the interest you earn in these savings accounts and investments could push you into the higher-rate bracket.

Higher-rate payers

Higher-rate payers also get a tax break from a personal savings allowance, but it’s limited to the first £500 of interest.

Therefore, you probably won't face tax on peer-to-peer lending for interest earned on the first £5,000 to £10,000 of your pot.

Additional-rate taxpayers

Additional-rate taxpayers have no personal savings allowance.

Non-taxpayers

Non-taxpayers pay no tax on P2P lending, provided their total income – including P2P and savings interest – remains under the £12,570 threshold for the basic rate of tax. Indeed, they can earn even more before being taxed, which we'll get to in a second…

Joint accounts

Married couples and civil partners each use their own personal savings allowances if you have separate P2P lending accounts. If you have a joint account, interest is split equally between you for tax purposes.

Tax when earning less than £17,570, including wages/pension and P2P interest

Taxpayers can earn £12,570 before their income from pensions or wages begins to be taxed. That's called the personal allowance. You're probably familiar with that allowance already, because it's the threshold at which we all pay tax.

The income-tax personal allowance is not to be confused with the personal savings allowance of £1,000, mentioned above.

However, you need to be earning £17,570 including wages, pensions, savings and P2P lending before facing any tax on peer-to-peer lending interest.

That additional £5,000 barrier, above the £12,570 personal allowance, is called the starting rate for savings.

I'll give you an example. If you earn £15,070 from your salary, you'll be taxed on £2,500 of that salary as usual, after deducting the £12,570 that is tax free.

On top of this, you can earn £2,500 in interest from savings and P2P lending before being taxed on total earnings over £17,570.

Another example: if your salary is £20,000, your P2P income doesn't benefit from the starting rate of savings, which ends at £17,570. However, you still benefit from the personal savings allowance of £1,000.

What common savings/investment products or financial products are covered by the above tax breaks?

The above breaks apply to interest earned using P2P lending sites that are regulated by the UK's Financial Conduct Authority.

All the above tax breaks – all the allowances and starting rates – apply to interest earned with all your savings accounts, including National Savings & Investments savings products. So it's not for your P2P lending only, but all combined.

Some lending that 4thWay classes as P2P lending is in the form of bonds or it is wrapped up in trust funds. Income from bonds or from trust funds is also covered by the above mentioned tax breaks.

On exceptionally rare occasions, some providers shown on 4thWay legally arrange lending in other ways. These are not covered by any of the above allowances, except for the bog-standard personal allowance of £12,570.

4thWay's reviews of UK-based P2P lending companies will specifically state if you don't benefit from the starting rate of savings or the personal savings allowance, due to the legal structure of your lending.

More on what qualifies for these allowances

I just want to briefly consider other savings and investments that also share the above tax breaks, although only wealthy people are likely to have any of these, or people receiving income from insurance products.

Standard Life, the insurer and pension provider, states that if you invest outside of pensions or shares ISAs in unit trusts, investment trusts or open-ended investment companies, and these are made up from over 60% bonds or other securities that pay a fixed interest rate, you can use your allowances here too.

To complete the list, also covered are: life annuity payments, payouts on a payment protection insurance (PPI) policy and some life insurance contracts.

How do I claim the above tax breaks?

You don't have to do anything to claim the above peer-to-peer lending tax breaks.

Please support 4thWay and not the plagiarisers!

We've recently found again that prominent organisations have copied parts of this page almost word for word. It's very common for our website to be plagiarised by hacks, but to us it doesn't feel like a victimless crime! We put a huge amount of effort into all our research and it comes with a great deal of skill and specialism, none of it is ripped off discreetly from other sources. All of our efforts cost a lot of time and money.

On the other hand, plagiarism can spread wrong and even dangerous ideas when hacks are copying each other, by editing parts down until they are no longer accurate. (It's just possible that some of that was the cause when some of the largest money sites were writing similar shaky guidance to each other on P2P lending, e.g. here.)

Please support 4thWay's high-quality research and expertise by signing up to our newsletter.

Plagiarising is wrong. If you write for a money website or a newspaper, 4thWay's Neil Faulkner is available to provide exclusive commentary for you, and you can disclose your sources in your articles.

How much income tax do I pay on peer-to-peer lending?

If you earn more P2P interest over-and-above your allowances and breaks, you’ll pay the same rate as your normal income-tax rate:

- Basic rate: 20%.

- Higher rate: 40%.

- Additional rate: 45%.

Do I pay tax on peer-to-peer lending losses?

We don't pay tax on peer-to-peer lending losses, so you only pay taxes on the money you actually receive after losses.

HMRC peer-to-peer lending tax rules allow you to offset your taxes using your loans that have been written off or charged-off. A write-off means all recovery efforts have ended. A charged-off loan is the remainder of any loan that's not completely written-off yet, but the prospects of recovery are very low.

Usually, the P2P lending companies will make it clear to you what your offsettable losses are in the tax statements they provide for you.

You can offset all your peer-to-peer lending losses against all your peer-to-peer lending interest income. However, you can’t offset peer-to-peer lending losses against gains from other types of savings and investments.

You can't use losses from inside an IFISA to offset taxes on interest earned in other P2P lending accounts.

If you're deeply unlucky and your losses exceed your interest income from peer-to-peer lending in a given year, you can carry forward those losses to the next year – and indeed for four years in total. This means that if you offset all your taxes for the year with losses, and have losses left over, you can use those losses in later years to reduce your tax bill.

More on how to claim relief later on.

Are peer-to-peer lending fees tax deductible?

On any interest earned over our tax-free limits, we're taxed on any lending fees that the peer-to-peer lending platforms charge directly to us lenders.

However, most platforms don't charge direct lending fees. They might charge variants like “loan servicing fees”, which nominally shift the fee to the borrower. But these are tax deductible. In reality, it really is just a matter of wording in the small print, but perfectly legal and accepted by HMRC.

For the platforms that still charge direct lending fees, if you earn 6% interest and pay a 1% fee, you’ll have earned 5% after fees. But you'll still have to pay tax on 6% interest.

(If a P2P lending site says it charges no lender fee, don't believe that means it is free to lend! Read There's No Such Thing as “No Lender Fee”.)

Is peer-to-peer lending cashback taxable?

HMRC guidance on cashback is very clear and so we can interpret it for P2P lending in a straightforward way: cashback is not taxable when it's offered to lenders in return for either signing up, lending, re-lending, or lending more money.

Indeed, any cashback encouragement to be their customer or to lend more is tax free.

However, it's also clear that if you earn money in return for doing something else, such as referring a friend, that cashback is taxable as income that HMRC calls “casual income” or “casual earnings”. You can earn £1,000 or less refer-a-friend cashback before it becomes taxable. You don't have to declare the income to HMRC until it becomes taxable.

That £1,000 allowance is shared with other casual income (e.g. if you make some clothes for a neighbour for a fee). Perhaps more critically, the £1,000 allowance is also shared with self-employment earnings, commission and freelance earnings. However, if you're employed, your PAYE salary and any bonuses or commission related to that does not count.

You'll find out how to declare this tax later on.

Do I pay income tax on interest already paid out when I buy an existing loan?

Some P2P lending websites allow you to buy a loan that has already commenced, typically through a secondary market (which is like the stock market for P2P lending).

Usually, in these cases, interest has already been paid to the previous lender, so there is little or no impact on you tax-wise.

However, if interest has been accrued and not yet paid – such as with loans that roll-up the interest so that the borrower pays it all at the end of the loan – you'll be liable for tax on all the accrued interest. In this case, when you buy the loan part from that lender, you also buy the interest that has already been earned. You also take on the tax for it.

Also, if the loan is repaid early, you could end up with a tax loss, because you might not earn enough interest in future to cover the tax debt that you've bought.

To eliminate this problem, you can factor that into your calculations when deciding what price to pay for existing loan parts (when you're allowed to offer less money for them). And you should spread your money across lots of loans so that you don't get unlucky on just one loan.

Do any P2P lending companies withhold income tax?

Not usually, but with some types of loans, when legally structured in a certain way, the P2P lending company is obliged to withhold taxes, usually at a rate of 20%. The P2P lending company then pays this directly to HM Revenue & Customs on your behalf.

You can claim back the withholding tax if you have overpaid; for example, if your tax breaks mean that you shouldn't have paid any tax on interest.

Just two peer-to-peer lending companies listed on 4thWay withhold taxes – and not on all their loans.

- CapitalRise withholds interest on its loans (bonds) when the loans are paying out interest on a quarterly basis. Its other loans pay the interest at the end – and that is paid in full to lenders without tax being deducted.

- Downing Crowd withholds tax when the bonds are for 365 days or more. If they are for less than that, you'll be paid all the interest without any taxes being deducted.

Do I pay capital gains tax when selling peer-to-peer lending loans for a profit?

We prodded and poked the taxman – aka HM Revenue & Customs – for straight answers (with limited success), we read and re-read its tax guides, and we consulted an accountant, who then discussed the matter with several other accountants.

It wasn't easy, but we now think we have a good handle on what the rules are regarding capital gains tax on peer-to-peer lending.

Firstly, the part that was always crystal clear:

- Very few people need to worry about paying capital gains tax (CGT).

- CGT is never due if you lend through IFISAs or pensions.

- You have to make a profit of £3,000 when selling your P2P loans and other investments before you need to read any further about capital gains tax. That is your annual, tax-free, capital gains tax allowance.

The grey area that we now think we've cleared up is: if and when do you pay capital gains tax outside of IFISAs and pensions? From our findings, here are the two key rules:

- If you are the original lender and you sell the loan to another person, you won't have to pay capital gains tax, even if you sell for an obscene profit.

- If you are selling loans for a profit that you have bought from another lender, these are taxable if you make profits above £3,000 in a single tax year on selling those loans and any other taxable investments.

Most of the time, P2P lending websites don't allow you to sell loans for more than you paid. Or they otherwise tightly cap the profits you can make doing by do so. This further reduces the chances that you will pay CGT.

You also need to make a very large profit on the sale of your investments before it even counts, due to the generous CGT allowance. If you've made huge loan sale profits and think you might be liable, only count the profits on second-hand loan sales when working out if you have exceeded your tax-free allowance.

Some P2P lending sites only sell second-hand loans, which were originally funded by a wealthy lender before the loans were moved onto the P2P lending website for resale. However, all or most of those P2P lending websites do not allow you to sell for a profit.

For the rare cases I pay CGT, how much do I pay?

For any gains over your capital gains tax allowance, you'll be charged 20% if you're a higher-rate or additional rate taxpayer.

Non-taxpayers and basic-rate taxpayers will pay between 10% and 20%. You need to calculate your tax rate like this:

- Deduct your income tax personal allowance and any other income tax reliefs from the income you earned that same year.

- Deduct the capital gains tax allowance from the capital gains you made to find your taxable gains.

- Add both 1 and 2 together.

- You pay CGT at 10% if your answer to 3 is £37,700 or less.

- If it is more than £37,700, you pay CGT at 20% on the excess.

You need to take into account all your capital gains for this calculation, i.e. P2P lending gains and other gains from investment sales.

Just a quick note to explain that, in this peer-to-peer lending tax guide, when we talk about how much you're earning or what taxes you're paying, we're talking about in a tax year, not a calendar year. So it's your income from the 6th April (the first day of a UK tax year) to the 5th April the following year.

How do I pay peer-to-peer lending taxes?

I'm not on self assessment, so how do I declare peer-to-peer lending income?

You pay income tax on any peer-to-peer lending interest that is not covered by the above breaks at your usual income-tax rate.

If you don't complete a self assessment tax return and have earned £10,000 or less in interest from savings and investments, get in touch with HM Revenue and Customs (HMRC) to let them know your P2P lending income before and after bad debts. HMRC will automatically change your tax code to pay the tax through your pension or salary. You don't have to do anything else.

Here's how:

- Print off the annual tax statements you get from the P2P lending companies. This should include any bad debts that you'll offset your lending with.

- Post them to your tax office with a brief letter stating you have untaxed income from peer-to-peer lending and that the evidence of the income is enclosed. If you prefer, you could simply take down the relevant details from the tax statements in your letter.

- Ask Revenue & Customs to adjust your income tax through your tax code.

I've earned over £10,000 in income from savings and investments, how do I declare P2P income to HMRC?

If you've earned over £10,000 in income from savings and investments, including P2P lending, you now need to complete a self assessment.

I think I should be on self assessment, so how do I declare P2P income?

If you complete a self assessment for any reason, and you've used up all your tax breaks for P2P interest, then you'll declare your P2P lending interest through that tax return.

If you think that, for whatever reason, you might have to complete a self assessment return, but don't know, you can check using HMRC's online tool.

How do I complete my self assessment for peer-to-peer lending tax on interest?

Peer-to-peer lending companies usually provide an annual tax statement to make it simple to declare our P2P income to the taxman, while offsetting that income against our P2P bad debts.

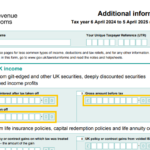

You can use these to complete the SA101 Additional Information form, which is an extra form to go with your self assessment tax return. It's easy to complete, especially with HMRC's very clear guidance.

Specifically, you enter your income in the section: “Other UK income. Interest from gilt-edged and other UK securities, deeply discounted securities and accrued income profits”.

This is what the SA101 looked like in 2024-5, and it's remained the same for many, many years. (Click on the image to enlarge and it will open in a new tab.)

This is what the SA101 looked like in 2024-5, and it's remained the same for many, many years. (Click on the image to enlarge and it will open in a new tab.)

In box 1 and box 3, you enter the interest you've earned from all your P2P lending to the nearest pound, i.e. the same figure in both boxes.

The two boxes will usually be the same because peer-to-peer lending companies do not deduct any of the tax from your interest in order to pay it to HMRC on your behalf. (A small number of exceptions do withhold income tax. Those are are outlined above.)

The interest you enter in those boxes is after deducting any eligible bad debts from all your P2P lending. P2P lending companies will usually make those clear to you in a tax statement. All your P2P losses can offset all your P2P income, outside of IFISAs.

If you claimed losses in earlier years, but the borrower later turned round and managed to make payments, you'll need to declare that as income in the same boxes. Again, this is often made clear on your tax statements.

If you have more losses that you're unable to offset this year, you don't have to note that anywhere in the tax return. Just save the details for next year.

In box 2, you will usually enter £0.00, because the P2P lending companies have not deducted any tax. So no tax has been “taken off”. If some of your loans are the exceptions mentioned above, this is where you'll enter the amount of tax that was withheld.

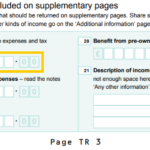

How do I complete my self assessment for refer-a-friend cashback?

To declare your casual income, including refer-a-friend cashback, when it's more than £1,000, you need to enter it in box 17 “Other taxable income” of the main tax return, which is on page “TR 3” (tax return 3) in the 2025 version.

To declare your casual income, including refer-a-friend cashback, when it's more than £1,000, you need to enter it in box 17 “Other taxable income” of the main tax return, which is on page “TR 3” (tax return 3) in the 2025 version.

This box hasn't changed or moved location in the return for a lot of years now. Click on the image to see what it looks like and it will open in a new tab.

Do IFISAs really offer completely tax free peer-to-peer lending?

P2P lending ISAs are now available. They're properly called Innovative Finance ISAs or “IFISAs”.

All interest and gains made in ISAs is completely tax free. These are still worth considering even if you currently earn less interest than your personal savings allowance.

Read everything you need to know about them, and see which IFISAs are available, in The IFISA Guide.

Can I do P2P lending through a pension?

Particularly if you have a large amount to lend and invest, you can also cut your taxes by lending through a pension. Read how to do this in our P2P Pensions Guide.

When there's not enough information

Tax on peer-to-peer lending works as described above for the vast majority of P2P lending companies. However, not all of them are structured the same way and in some cases the tax situation is unclear due to insufficient information from the P2P lending company itself on how it's legally operating. The biggest unknown listed on 4thWay at the moment is Somo. There's not enough information about its trust structure for us to assess how you are taxed, how much, what tax breaks you have and how you declare any of the interest income.

This was part eight of our ten-page P2P lending guide

Read part seven: Peer-to-Peer Lending Vs Other Investments.

Read part nine: The IFISA (P2P ISA) Guide.

See the contents of the whole guide.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

Sources: Representatives from HM Revenue & Customs and its published guidance; various accountants, especially Rodliffe Accounting; various peer-to-peer lending companies; SIPPclub; Standard Life.

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.