See why 4thWay now accepts ethical ads.

See why 4thWay now accepts ethical ads.

10 Things To Look For In P2P Property Loans

It's not always easy to spread your money across hundreds of P2P property loans, because the deals are bigger and fewer in number.

To counter for that, you have the extra protection of being able to repossess and sell the property if the borrower can't repay. That is to say, the P2P lending websites you use can do all that hard work on your behalf.

But there's more to lending against property than relying on repossessions! Here's a list of 10 key items that we look for in property loans:

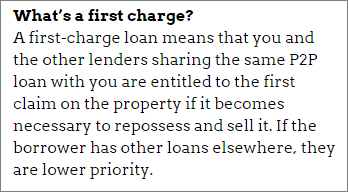

1. Be first in the queue if the borrower can't repay

You want to be sure that, if the borrower can't repay and the property needs to be repossessed and sold, you are first in the queue to receive the proceeds.

So  you want to see that the property has a “first charge” or that it is “held in trust” on your behalf.

you want to see that the property has a “first charge” or that it is “held in trust” on your behalf.

This means that you get repaid first, and any other loans to the same borrower are not repaid until after you have got every penny you're owed.

If the loan is second charge or worse, the risk rises dramatically and it becomes much harder to estimate what a fair interest rate is for the loan.

2. Check it's not the same borrower

You want to check that the loan you're looking at taking part in is not another loan to a borrower you're already lending to. That's all part of spreading out your risks.

Particularly with developer loans, you can easily end up lending more than once to a single borrower, since they might have lots of projects on the go at once.

The borrower might even have several different loans on the same development, since it's common to take out a loan on the first part of the development work, and then take out more loans in stages when the money is needed. This is all planned for at the beginning.

The borrower might have taken out loans from different providers, so cross-reference borrowers on all the property P2P lending websites you use.

3. Look for good rental income

It really lowers your risks when a loan is against a property that is already tenanted and earning rent. The property can pretty much pay for itself!

Landbay, a P2P lending website that 4thWay® rates as low risk, offers buy-to-let residential mortgages only. Rental cover has to be at least 125% of the monthly mortgage payment and it is currently averaging 170%.

Many other property P2P loans are developer loans or bridging loans. Developer loans are on untenanted properties, since the developer is yet to complete them.

Bridging loans are often to make a purchase before another property sale goes through, so you can't expect these loans to be earning rent from the word Go either.

Still, you can try to ascertain what the rental income will be on completion of a project, which could potentially give a buffer in the event that the property can't be sold quickly at the end of the loan.

Learn more about Landbay in Get Started With the Safest Peer-to-Peer Lending Websites.

4. Small loan compared to property value

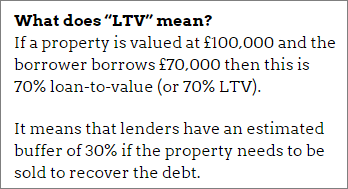

You want to see that the “loan-to-value” (LTV) is low. (See sidebox for a definition of loan-to-value.)

You want to see that the “loan-to-value” (LTV) is low. (See sidebox for a definition of loan-to-value.)

Property P2P lending websites typically have an average loan-to-value below 70% and sometimes even below 60%.

The lower this figure is, the bigger your buffer in case of property mis-valuation or a property price crash.

On LTVs and rental income

Let's just expand on items three and four in this ten item list: good rental income and low LTVs.

Both of them reduce a) the likelihood of loans going bad and b) the size of any losses you might make if they do.

However, high rental income is arguably more important for the former and low LTVs more important for the latter.

Landbay has clear boundaries: minimum 125% rental income cover and maximum 80% loan-to-value. In contrast, Wellesley & Co‘s boundaries are less clear – but the loan-to-values average just 60% and our money is automatically spread across the entire loanbook of more than 100 loans. So you can be flexible.

5. Borrower selectivity

Some services, like Wellesley & Co., have admitted to being relatively sanguine about the borrowers. However, they focus heavily on the properties when assessing loans.

But you still might want to see that the borrowers are experienced. If not, make sure other criteria, such as rental cover and LTVs, are especially good.

Don't confuse experience with a large property portfolio. Funding Circle‘s head of property, Luke Jooste, has said that he's seen property empires collapse quickly. The key message is that even great property developers can over extend themselves by borrowing too much against all their properties.

What you really want to look for are lots of years experience as a landlord or property developer, preferably through some bad economic times, with a consistent record of profitably completed projects.

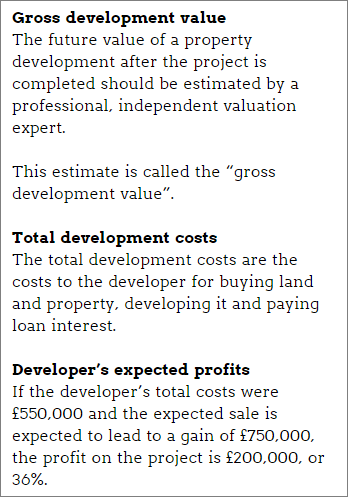

6. Expected developer profits

When it comes to developer loans, borrowers should expect a return of 15% on costs at the very least.

it comes to developer loans, borrowers should expect a return of 15% on costs at the very least.

If the borrowers are taking on a project and not going to get a decent reward for the risks they're taking then lenders like us need to worry why they can't do their sums properly.

To estimate the returns borrowers will get, look for the “gross development value” and divide it by the total development costs. (See sidebox.)

You want the answer to be at least 1.15, which indicates a 15% profit.

Although more would give you a much greater barrier in case of mis-valuation, property crashes, spiralling development costs or other problems.

7. Actual historical bad debts

Now we're getting into more general criteria surrounding the P2P lending websites themselves, rather than the individual loans.

You want to see that the historical bad debts are low, especially comparable to other similar property P2P lending websites.

Right now, most P2P lending websites focused on lending against property in the UK have zero or near zero bad debts. During moderate to good economic times, this is what you should probably expect when going for the lowest-risk options.

8. Length and breadth of history

Ideally, you want to see that the P2P lending website has been operating for some time and that a good number of loans have been matched. The more loans that have been completed and paid off, the better.

Right now, we count 20 property P2P lending websites, but most of them are very new.

Theree are virtually no property P2P lending websites with a big, long record, although Funding Circle has done £45 million of property loans in 12 months and Assetz Capital has done property loans for two years. ThinCats has been around for 3-4 years, whereas Landbay and Proplend are relatively new.

LendInvest has been around since 2013, although the people running it have a great record in bridging loans extending back to 2007.

9. Ability to spread your money around

You want to see that you can easily spread your risks by spreading your money around. Because it is vital that you do so for your own safety.

The good news is that you can do that easily if you use several different P2P lending websites.

For example, inside just one month, you can expect to have your money split between at least ten property loans on Landbay, at least 100 on Wellesley, and around one or two dozen A+ property loans on Funding Circle. All of which are rated as low risk by 4thWay®.

None of those P2P lending websites have yet experienced any bad debts on property loans.

10. Ease of re-lending

You want it to be easy to re-lend money. For that, you need to see a constant stream of new deals and minimum lending amounts that are low enough for you to re-lend any regular interest payments you expect to receive.

Re-lending your money lowers your risks in two ways. Firstly, by lending and re-lending for longer, you can much more easily take, and recover from, any short-term hits from a bad economy or falling property market.

Secondly, by re-lending your interest and loan repayments as you receive them, you spread out into even more loans.

Stay safe!

Make sure you stay-up-to-date! Not all P2P lending websites that are safe today will be safe tomorrow. 4thWay® updates subscribers if any of a variety of warning signs start flashing. Sign up below.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Funding Circle, Landbay and Wellesley, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.