See why 4thWay now accepts ethical ads.

See why 4thWay now accepts ethical ads.

Wellesley P2P ISA Bond is Not P2P Lending

Note that, since this article was published, Wellesley & Co. has greatly clarified its marketing and re-named the bond the Wellesley Listed Bond.

Wellesley & Co. has been offering one of the safer P2P lending opportunities for individuals like you and me.

However, its new ISA is not the same kettle of fish. It is called the Wellesley P2P ISA Bond, but there's no actual P2P lending in it.

In the near future we will have peer-to-peer lending in ISAs, but we don't yet.

What is the Wellesley P2P ISA Bond?

The Wellesley P2P ISA Bond is a retail bond.

The “bond” part of that means you are lending to Wellesley, not to lots of individual borrowers.

The “retail” part of retail bond means that the bond is sold directly to individuals like you and me.

Many companies, from Ladbrokes to Tesco, issue retail bonds.

A retail bond is not to be confused with a savings bond offered by your bank, which, for all intents and purposes, is identical to a fixed-rate savings account.

It is also not to be confused with peer-to-peer lending.

I just have to make one thing clear!

The ISA bond and how it's been created ahead of new official rules for P2P is quite brilliant in its ingenuity.

However, I have to hammer this point home because I'm concerned that many people visiting Wellesley's website and reading articles about its ISA from less knowledgeable sources will think that the ISA is peer-to-peer lending, when it isn't.

Here's me hammering it home:

The Wellesley P2P ISA Bond is not peer-to-peer lending.

Although this bond has “P2P” in its name, you will not be peer-to-peer lending.

And although the web page explaining key risks of the bond says in its key risks section: “Investing in Peer-to-Peer lending involves risk to your capital” this is not P2P lending.

And although Wellesley is selling itself as “the first peer-to-peer (P2P) lender in the UK to offer an ISA eligible bond with tax free returns on P2P lending,” the ISA bond is not P2P lending.

And although it says the bond “differs from any other retail bond, in that it provides unprecedented access to the fast-growing Peer-to-Peer market,” it is still not peer-to-peer lending, and it is a retail bond.

Update on 20 February: On reading this article, “kermie” from the P2P Independent Forum summarised this in a neat way: ‘It's like Tesco describing their retail bond as a “Tesco Grocery ISA Bond”. The ‘grocery' part is just their business model, and you ain't buying groceries with that bond!'

My work ends there

It is not P2P lending, so technically I should stop writing here. 4thWay® is just about P2P lending, and we don't assess individual investments opportunities unless they are individual P2P loans.

So I won't be telling you whether it's a good or bad idea to lend to Wellesley through its bond.

However, I want to at least help you understand the key differences between the bond and P2P lending. So I've read Wellesley's 135-page prospectus and its literature on its website to identify those differences.

I'll tell you those differences, as I understand them, right now. And then, if you want to know how the bonds might impact the risks of doing P2P lending through Wellesley, read Matt's Candid Opinion blog, Do ISA Bonds Make Wellesley Lending Less Safe?

How the Wellesley P2P ISA bonds differ from P2P lending

Here's how the bond differs from P2P lending:

Difference one: you're lending to Wellesley itself

With the Wellesley P2P ISA Bond, you're lending your money to Wellesley alone, not to diverse businesses.

Wellesley is looking to borrow £20 million from people like you with the first issue of its ISA bond, and potentially as much as £500 million in the longer run.

There are some technical considerations that I shan't go into (although you must, if you're interested in lending to Wellesley through the ISA bonds). One key technical consideration is that Wellesley set up a separate company, that it wholly owns, which issues the retail bonds.

Difference two: the key risk is different

Since you're lending to Wellesley and not to lots of individual borrowers, taking part in the bond depends on your assessment of Wellesley's financial strength more than ever.

That said, if Wellesley owns the loan parts bought with your ISA money, the administrators will continue to collect any borrower repayments and pay off Wellesley lenders, i.e. its ISA bondholders, after deducting their fees. This is a bit of a jumble that is something more for a lawyer, accountant or insolvency expert, rather than little old me.

Usually the main consideration in peer-to-peer lending, in contrast to the Wellesley ISA bond, is the strength of the many borrowers you're going to lend to, and the safeguards that the P2P lending company offers to protect you from loans going bad.

Difference three: a considerably more complicated offer

You also have a considerably different offer. If you compare the terms and conditions for individuals P2P lending their money through Wellesley to the full prospectus for the ISA bondholders, you have a lot more reading and understanding to do before you can grasp what you're getting involved in.

Difference four: your relationship with borrowers

With these ISA bonds, you will nominally be assigned to borrowers. You won't actually be lending to them – you lend to Wellesley. In this regard, it's more similar to buying a retail bond from an ordinary bridging loans or developer loans company.

In the ISA bond prospectus it states you might (nominally) lend as much as 20% of your money to one borrower. But Wellesley's own website and other literature appears to supersede that by stating that you will (nominally) spread your risks between all the same borrowers as those who do P2P lending through Wellesley, which currently means automatically spreading risk between more than 100 outstanding loans.

And your investment in, and returns from, the ISA bond will also benefit from Wellesley's key safeguards, including the bad-debt provision fund and, according to an email from Wellesley, an extension of its promise to take the first loss on any loan that goes bad.

Provided Wellesley doesn't go insolvent, then, it looks like those using the ISA bonds should be in pretty much the same boat as those individuals that do P2P lending through Wellesley.

Difference five: if Wellesley goes insolvent

The loans Wellesley makes that are nominally assigned to the ISA bonds are rated equally with the P2P lending side when it comes to recovering losses. So if lots of loans go bad, and the sale of the properties doesn't cover all debts, and then the bad-debt provision fund is overwhelmed, Wellesley should share an equal recovery with the Wellesley P2P lenders, e.g. 95p in the pound.

But that doesn't necessarily mean that bondholders will get all that 95p. Because Wellesley might have borrowed from others, e.g. banks, which get a cut too.

So if Wellesley does go insolvent, any loan repayments and recoveries due to Wellesley (as opposed to individual lenders) will be due to be paid out to Wellesley's lenders. That means ISA bondholders but it also means any other top-level secured lenders to Wellesley. The prospectus refers to “some” such other lenders that share priority when it comes to carving up the remains of Wellesley.

It wasn't not clear if those lenders are hypothetical, real, or coming soon. But, if they're real, you will have to share some of the proceeds of your nominal 95p in the pound with businesses that have also lent to Wellesley.

Difference six: interest rates and taxes

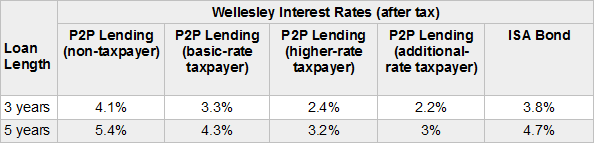

We always convert all Wellesley's interest rates so that they're calculated on the same basis as all the other P2P lending companies, so that you can compare rates properly. That's why the rates in the table below are different to those on the website.

For brevity's sake, I hope you'll take my word for it that the rates below give you a better and more easily comparable picture of what you'll earn than those on Wellesley's website.

Sorry for the complicated table showing lots of different tax rates. That just gives me an inkling of the headache it's going to be when we have to start presenting rates to you when P2P lending companies really do start offering P2P ISAs.

As you can see, higher- and additional-rate taxpayers are offered higher potential returns with the ISA bond due to dodging taxes. Basic-rate payers can get a smidgeon higher too. Only non-taxpayers get higher expected returns while P2P lending through Wellesley instead of through its ISA bond.

Difference seven: getting out of the ISA bond

To exit the ISA bond, you trade it on the Irish Stock Exchange. Trading on the exchange may mean you get less – or more – than you put in.

This differs to P2P lending through Wellesley, whereby you can usually expect to be able to sell your loans back to Wellesley for the same amount you put in.

Particularly in abnormal (e.g. horrendous) economic times, getting out of either the ISA bonds or your Wellesley P2P lending might be a problem. This is always true of all investments, although which will be easier to exit is up for debate.

There are extra costs for selling the bonds (£50) and it will cost at least £120 to transfer your ISA elsewhere.

Difference eight: minimum lending amounts

You can lend as little as £10 through Wellesley, whereas the ISA bond minimum is £1,000.

Difference nine: no 4thWay® Risk Rating

4thWay® won't risk rate bonds because they're not P2P lending.

Lots of research ahead of you

Personally, I'm not currently in the position to make a call as to whether the interest rates Wellesley offers to pay you for lending to it through its ISA bond are reasonable under the circumstances. Please do your research carefully.

The ISA bond prospectus appears to have been drafted some time ago. It still states that Wellesley is a member of the Peer-to-Peer Finance Association. But it left the association some months ago. Ironically, one source claimed this might be due to a disagreement about how it markets its bonds.

The Financial Conduct Authority also warned recently that it was concerned about how some bonds are being marketed by “crowdfunding platforms”, which is its catch-all name for a sector that includes P2P lending companies.

Read more: Do ISA Bonds Make Wellesley Lending Less Safe?

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Wellesley & Co., and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or when you make an investment, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.