See why 4thWay now accepts ethical ads.

See why 4thWay now accepts ethical ads.

CrowdProperty Review

Reduced transparency, so a cautious assessment concludes potential overall losses for lenders on loans from the early 2020s, with newer and future loans probably better

CrowdProperty's Bridging & Development loans are unrated.

This account has recently been paying lenders 9.13% interest before bad debts.

The latest on CrowdProperty in winter 2025/26

The text in this box with a gold border is from December 2025. The rest of this review was written in July 2025.

Openness at CrowdProperty for existing lenders…

Existing lenders have provided me with mixed messages on whether written updates and reporting from CrowdProperty on their specific loans has improved since the summer.

Lenders have said that their attempts to get in touch with executives have been ignored, despite CrowdProperty’s assurance to me that every lender may talk to a senior member of the board.

…And for new lenders

For new lenders and for those who want to understand the overall picture of performance to assess the risks of lending through CrowdProperty, the transparency outlook has worsened in my view.

CrowdProperty has just refreshed its website, but in so doing it did not bring back its public, detailed statistics tables on historical and current performance.

These disappeared some time ago, but CrowdProperty had told us and the public back then that it would soon provide new and improved tables.

They are now gone, seemingly forever – right at the time that CrowdProperty is producing its worst performance.

Results since our last update

Like other P2P lending providers, CrowdProperty is required to provide some basic figures by the regulator in an annual outcomes statement.

CrowdProperty has published its 2025 outcomes statement a little early.

Information in it is sparse, but it states that there have so far been 81 technical defaults on development projects that have turned bad between 2018 and 2024.

While the term “technical default” usually means just about any breach of loan contract, especially regarding payment dates, it is likely that CrowdProperty is tallying just the projects with loans that are over 180 days beyond their anticipated repayment date.

The last loanbook dataset CrowdProperty ever sent us included performance up to May 2025. That showed 45 out of about 430 different projects from 2018 to 2024 had fallen half-a-year late. CrowdProperty's outcomes statement tally of 81 therefore suggests that the conditions have continued to worsen.

It seems then that, if 4thWay was still receiving data from CrowdProperty, I would likely today enter worse projections in the table in this review headed “Possible returns or losses by year loans were made”.

More senior departures

I previously reported that the CEO left in spring. The last of the co-founders, Andrew Hall, followed him in August.

Hall was the director who headed up the assessment process and was therefore long responsible for the quality of the loan book.

He has now retired after a 40-year career, with nearly 12 at CrowdProperty.

CrowdProperty's head of compliance left in the same month as Hall. That is the role that ensures the business follows its legal and regulatory duties correctly.

Do remember to keep perspective

It’s not easy to keep perspective when there’s a huge deficit in information.

Even so, I believe less than two loans in every 100 ever approved have so far seen lenders lose any money. Under the circumstances of passing through these really rough economic conditions for developers, it’s absolutely expected that there are more losses.

Visit CrowdProperty or keep reading the CrowdProperty Review.

I don’t intend to make a habit of this, but this is probably the longest assessment that I or anyone else at 4thWay has written up for external readers. It’s also much more technical than usual in large sections.

If you don’t want to read this entire page, all of the key points you need to know are in bold, so you can skip through by reading those bits.

When did CrowdProperty start?

Established in 2015, lenders have lent £455 million to nearly 300 different borrowers in approximately 1,000 tranches of loans paid out to fund property developers.

CrowdProperty is mainly focused on property development lending where online lenders are first in the queue to get their money back above other lenders and where all the developments already have planning permission.

It sometimes also offers short-term (bridging) loans to developers, e.g. for allowing extra time to sell a property after it’s completed.

I’ve noticed that lenders tend to be shocked by bad news, because it doesn’t matter how many times we warn you that things will sometimes go wrong for each of us. I think for many of you it’s because you become too comfortable, due to everything going smoothly for you most of the time.

A fair proportion of lenders, I’ve learned, are therefore so stunned at any bad news that they panic and are unable to take in any rational information or thoughts from that point onwards. So those lenders go on to do all the wrong things, rather than taking the bad news all in stride as part of what happens when investing, which includes money lending online.

The worst part for you when you panic is often not that you worsen the news by making decisions and reacting in a way that weakens your finances. The worst part is how badly you feel about yourselves and others. There’s no need to feel that way. You just need to accept that hiccups are part of investing, move on, and keep to sensible lending strategies.

Keep in mind – as I’ll show you later on – that if you have had a sensible minimum level of diversification across lending accounts you can still expect to have highly satisfactory results.

There’s not much more I can do to prepare you emotionally, so top marks to those of you who keep your heads.

What interesting or unique points does CrowdProperty have?

CrowdProperty has one of the largest in-house teams of people who have a great deal of relevant property and banking experience, including now some at a senior level going back to the financial crisis and Great Recession of 2008.

The early 2020s set off a worst-case scenario event in the broader property development and property-development lending space.

Largely as a result of that, CrowdProperty is the first online lending provider to apparently have reached, almost spot on (within 0.1 percentage points), as many loans turning bad and needing recovery action than we model for in our worst-case scenarios.

How much experience do CrowdProperty’s key people have?

The head of credit since August 2024 has a lot of experience in lending with distressed debts, including those secured on real property. With her banking background, she has identified many areas to improve CrowdProperty’s lending processes that I expect to have an impact. In particular, I’m looking for more consistent results from now on.

She doesn’t have a substantial history focused on residential development lending and I would have very much liked to have seen that – because there’s just no lending like development lending.

She is, however, backed up by a great deal of experience in property and banking at CrowdProperty, including a major hire two years ago that heads a team managing the more problematic loans.

An independent RICS surveyor assesses every development project at the outset. An independent surveyor will usually visit developments that have been funded once a month. But CrowdProperty also has an in-house team of RICS surveyors keeping track of progress.

CrowdProperty review: lending processes

A brief aside

Here’s a simplified lesson for showing the limitations of any assessment you, 4thWay or anyone else can make on the lending processes that platforms describe to us and provide supporting documentation for in long sessions, and why it can only ever be one of the angles used in assessing a particular P2P lending provider.

This is a transcribed quote from CrowdProperty on our files:

“[Our underwriting processes are] a big topic. 57 steps [developed] over many years. There’s a big process flow chart on the wall next to the borrower team outlining the 57 steps and we’re constantly improving it, learning. We’re constantly iterating and focusing on what we’re doing – not mezz, equity: just getting better at what we’re doing. Building competitive advantage using minutiae of perfection.”

That quote was back in 2019. Today, in 2025, despite what must by that point have already been years of constant iteration, learning and minutiae of perfection, and then six more years thereafter, CrowdProperty has recently made substantial changes to professionalise what it does. Changes that I argue equate to more than minutiae…

Recent changes to CrowdProperty’s lending policy

The new head of credit has implemented a lending policy that now makes it clearer to lending managers what they can and can’t accept as applications come in: what the rules are upon which they approve and reject a loan, and price interest rates. It’s also now easier for them to see whether a potential loan deal will fit with CrowdProperty lenders’ appetite for risk.

CrowdProperty now more diligently documents everything it believes it needs to know to make a good decision, including risks, mitigants and the all-important cash flow into and out of the project.

The borrowers themselves are considered more comprehensively than before. This is frankly essential, as it has typically described its borrowers being at the higher end of premium. It’s not easy to have the absolute cream of development lending without being thorough on both the property project and the developer.)

CrowdProperty’s key ratios

CrowdProperty has stuck for a long time to its maximum loan amounts versus the property values, which remain unchanged.

The initial tranche that developers raise through CrowdProperty is usually no more than 70% of the starting valuation of the property. (A so-called 70% loan-to-value ratio or “LTV”.)

And the total planned to be raised (in multiple tranches) and lent to the developers – the total facility agreed – is usually no more than 70% of the hoped-for sale price of the completed development. (This is the so-called loan-to-gross-development-value ratio or “LTGDV”.)

While CrowdProperty has stuck to both those maximums for a long time, in reality this limit might now be being slightly exceeded due to the way it charges and reconciles interest to borrowers, which isn’t always reflected in those ratios. Although that’s unclear.

But the average starting LTV is currently now relatively low at closer to 50% when it has been above 60%. Even 60%ish is generally reasonable for first-charge lending. (“First charge” means that you get paid back first – especially useful in the event the property needs to be forcibly sold.)

CrowdProperty has not, however, stated that it is deliberately clamping down on LTVs, so we should presume for now the movement is natural variance rather than planned.

The average LTGDV is below peak (and lower is better). But it’s still maybe five to seven percentage points higher than in CrowdProperty’s early years. That is currently normal across the market, due to developer cost pressures rising faster than house prices at present.

CrowdProperty accepts some borrowers with a little adverse credit history, maxing the amount that can be borrowed by them slightly lower, at perhaps 60% or 65% LTV/LTGDV.

CrowdProperty has recently approved few bridging loans, but is likely to do more of them to help its existing developers, who continue to be stretched. The maximum loan allowed is as much as 75% of the property value. That’s a bit higher than we’d ideally like, but not many loans hit that level.

The last we were told, CrowdProperty will consider funding up to 100% of the construction costs, which is higher than usual. An 80% maximum has typically been more standard.

CrowdProperty continues to use profit-on-cost (POC) as an important internal metric, but it doesn’t use loan-to-cost (LTC) when making decisions on loan applications.

Let me explain those.

LTC primarily helps to ensure that borrowers have enough skin in the game, as the lower the loan amount is compared to all the costs of doing the project, the more the borrower usually has to fund themselves to make up the remaining costs.

POC shows what the profit will be as a percentage of the costs, e.g £100,000 profit on £400,000 total costs would be a 25% expected POC (which would be very healthy).

The relationship between the two is that the higher the LTC, the greater the expected POC needs to be, or the greater the confidence in it, in order to contain risks. I had previously written that CrowdProperty might do better to be “more strict on loan-to-cost”. Now I say I would prefer to see LTC specifically used in the lending decision.

Nevertheless, CrowdProperty does require the developer to have a stake, so at least it’s still looking at that aspect from a different angle.

More on CrowdProperty’s lending policy

CrowdProperty does all the usual checks on the developer’s own assessment of the project, whether it appears to make sense and stack up cost-wise, and getting professional third-party RICS valuations.

Developers usually raise the money they need through CrowdProperty in tranches, as each phase of the development is completed. That’s pretty common in P2P development lending, but it’s not optimal. It means there’s a risk that funding will dry up part way through a development project, that the developer can’t complete it, and that lenders are at a slightly greater risk of not getting all their money back.

I had previously written that CrowdProperty would be better “to raise the full funds to take developments to completion in advance”. I believe CrowdProperty still has a large enough number of users who remain fans that it can fund future loan tranches on existing developments. However, the more issues that CrowdProperty has – and the less transparent it becomes – the more likely it is that lending will dry up mid-project.

The credit committee that signs approval to go ahead with a loan now is a minimum of three and it needs three people to agree to go ahead. I would prefer the decision always had to be unanimous, although in practice it usually is, because normally just three sit on the decision. Each decision needs at least one person with a heavy property background and at least one person heavy on banking.

CrowdProperty’s processes when loans turn problematic

Usually, the prospects of recovering money in full are greater the quicker you acknowledge and start acting on any problem debts.

The data demonstrably shows CrowdProperty has historically taken longer than its most similar competitors to log loans as bad debts.

While that may be the case, it has independent surveyors who are usually on site once a month, an in-house team that are now split between performing loans and problematic loans, and it has regular meetings about all loans that are suffering (as well as the good loans).

Out of necessity, I am conservative in my projections on how bad debts will pan out in the lengthy section that follows this one. But, even as I provide an overwhelming level of detail in that section, you still need to try to keep in mind a few other items of note that can mitigate the risks in the existing loans.

Firstly, CrowdProperty has previously taken us through the steps it took on some of its loans that fell substantially late. It typically found elegant solutions to ensure lenders received all their money and interest in the end. This means that potentially it will manage to repeat that for many more of the loans that it now has officially classified as bad debts in its submissions to us.

Secondly, while it might have historically been slower than similar competitors to classify loans as bad, I think it more likely than not that it’s reacting strongly to projects that are struggling to stay on track – even when it hasn’t reported on it.

Just one final point before we come to a very long section that is heavy but essential reading for CrowdProperty lenders.

CrowdProperty had previously told us that its own experienced founders step in to run development projects to completion, if necessary. It made a very big deal of that in its early years.

Now, when questioned directly on this, CrowdProperty says that in these cases it works with specialist receivers who see the development projects through – specialists not just in dealing with borrowers who are unable to repay but who have experience in completing development projects.

While that is more normal in development lending, it’s much more costly than CrowdProperty doing it themselves and it could substantially eat into what lenders get back.

How good are CrowdProperty’s interest rates, bad debts and margin of safety?

CrowdProperty’s lending rates remain about 2 percentage points higher than in the past, averaging around 9.13%, to combat inflation as well as the increased risk of losses in recent years.

The rates are appropriate for the type of lending CrowdProperty has been aiming for.

The rest of this section is going to look not at the reward side – the lending rates – but the risk side, specifically of bad debts.

This is by far the longest section I’ve ever written on this one subject for any peer-to-peer lending provider by a considerable margin. Apologies for that.

How are CrowdProperty’s loans performing?

Historically, nearly 16 out of every 100 loan tranches have turned bad, according to CrowdProperty.

Based on our own stricter definition – which has previously turned out to be more accurate in the long run – the total is probably more like 20 out of 100.

Before I mention more statistics and figures: the data we have received from CrowdProperty of late has been broken in a variety of ways, which we have ascertained from questioning CrowdProperty, from talking to lenders and, above all, from cross-checking different data sets of CrowdProperty’s full loan history. While we can spot and fix a lot of it, or ask for it to be fixed, it does mean that some figures and percentages provided for you in this review will be off, but it’s a lot better than nothing. We’ll let our newsletter subscribers know to re-visit this CrowdProperty Review, if CrowdProperty substantially improves on the quality of data it provides.

For contrast, roughly three years ago, CrowdProperty’s data was showing that it had never considered any of its loans to have turned bad and requiring recovery procedures. (We thought 7% was likely to be a more useful estimate of loans in some trouble at the time. In hindsight we happened to be right.)

Most CrowdProperty loans are development loans rather than bridging. CrowdProperty typically raises funds for developments in tranches, as different stages of the project are completed.

Looking at the outstanding loanbook rather than the full historical one, 39 out of every 100 loan tranches are bad debts that are currently in recovery procedures.

As much as 50 in a hundred are potential bad debts by 4thWay’s stricter definition.

By either definition, this is a very high proportion of bad debts for this kind of lending. It’s also high compared to all CrowdProperty’s most similar competitors for which we also received datasets.

Some background: the troubles faced by CrowdProperty’s borrowers

In the previous update to this CrowdProperty Review, I wrote:

“Looking back, a lot less than 0.1% of the total amount lent through CrowdProperty has been written off after all recovery attempts were completed.

“Looking forward, I expect more losses on outstanding development projects that were approved for lending 1-3 years ago…Fully a third of outstanding development lending – that’s £47 million – has been delayed by at least 180 days or has fallen into official default.

“It’s a climactic moment, as this will likely prove to be the peak of the delayed or troubled developments. Now it only remains for us to see what proportion ends unhappily.”

I went on to add that the proportion of loans that were either very late or had turned officially bad were still within our stress-test conditions.

Now, the proportion of loans that have been acknowledged as bad debts has risen to be within 0.1 percentage points of our model for the worst-case scenario.

There was an unquestionably extraordinary series of bad news for virtually all property developers – and therefore their money lenders like you – around the early 2020s. In lending terms this is now, a few years later, coming to a head.

There was an exodus of skilled construction workers as the impact of Brexit eventually started to hit, which was then greatly exacerbated by the pandemic. Supply chains got destroyed and high inflation hit the cost of construction materials. Then, in autumn 2022, interest rates shot up, which stamped on property-buyer demand, and developers are taking longer to sell out.

I had previously written that CrowdProperty should “potentially provide more runway to the [development] projects by assuming more potential delays” from the outset. This turned out to be prescient. While lending to developers that have additional runway would not have offset all of the stressed conditions developers are going through, it would certainly have helped.

4thWay chooses to stress test based on a severe recession and major property crash, but other stressed economic conditions such as those I’ve just listed can have the same or worse impact on particular types of lending or types of borrower.

With a huge number of property developers having gone through an intensely dire patch recently, developments starting between about 2020 and 2023 continue to have lingering issues.

So a very big increase in problem debts to resolve has been almost inevitable across the industry, and therefore fully understandable. That’s why lenders diversify, to limit any particular exposure.

However, the scale of problem debts at CrowdProperty are the worst we have from any providers that have focused on first-charge, prime-development lending.

We have always said that this would happen occasionally, because the risks that emerge in tough times will sometimes surpass even the most careful forecasts. And each online lending provider will be exposed to its very specific target base of borrowers, which sometimes will be hit harder than others in surprising ways.

And that’s why we’ve repeatedly said that our assessments only make sense if you lend across a large number of lending accounts to contain such risks.

The future prospects of recovery for these outstanding bad debts

Even so, that doesn’t let CrowdProperty off the hook.

When there’s a much higher proportion of loans that are currently bad and in recovery, it’s something that requires looking further down the line to see the prospects of recovery.

That’s the second half of the picture: excellent recoveries, or excellent prospects of recovery, can be the complete saviour – provided that’s built into the policies and plans that were conceived of from the beginning.

Unfortunately, it is exactly here, in this aspect of the analysis, that CrowdProperty, for the first time, has completely shut the doors on our assessment.

CrowdProperty has rejected my request for specific data regarding the prospects and expectations of recovery, as well as for status reports on each individual problematic loan.

And it didn’t comply with my request for, at the very least, summary figures of the amounts it expects to recover from outstanding bad debts.

Instead, it offered more in the line of a general statement about the state of the market and CrowdProperty’s efforts.

This near non-existent disclosure is at odds with many other P2P lending providers, which even ask to talk us through each of their loans that are facing issues, being open about their prognosis, and discussing the steps they’re taking to reduce or eliminate any hit to lenders.

The reason it gave for limiting its transparency in these ways was the confidentiality it has with financial institutions that also lend through CrowdProperty.

But it’s hard to reconcile the massive amount of data CrowdProperty provides 4thWay on the actual lending results and recoveries as they happen, with this new, conflicting assertion of confidentiality merely over forecasts of what they expect to recover.

After all, we will learn the reality over the coming months and years as its real data gets updated, so rejecting even 4thWay’s diminished request for some simple best forecasts is weird. I just do not understand it.

Furthermore, since small lenders continue to get some sort of updates on their individual loans, to now deny 4thWay even the same basic updates currently seems to me to be contradictory.

The reduced transparency (in combination with data submissions that contain more detectable errors than they used to) leaves us in an unfortunate position when it comes to assessing where this seemingly highly distressed loanbook will end up, but we have a clear rule for this situation…

Conservative estimates of write-offs and results to come on existing loans

The analysis I will lay out for you below on recovery prospects is limited by the small amount of data provided to me on that particular aspect. Whenever this is the case – as we have always said since 4thWay started – it’s appropriate to be conservative.

As we have always told you at these times, whenever transparency is missing, and especially when it’s withdrawn or goes back a big step, we’re required to treat that with real cynicism. (This has been principle three of 4thWay’s 10 P2P Investing Principles since we started.)

We’ve found a good correlation between this cynical standpoint and the reality in the long run. While it might sometimes end up being unfair on specific P2P lending companies – as it could end up being to CrowdProperty – any individual lender or investor’s biggest concern should be preservation of their money over all else. That’s why we have this principle, applied universally against all peer-to-peer lending providers. And it has served lenders well.

What I can tell you is that CrowdProperty’s data shows us 14 loan tranches have had write-offs. Meanwhile, just four of the tranches that CrowdProperty has ever acknowledged to us as bad debts have been recovered in full (at least the underlying loan if not all interest), according to the detailed data it provides for the purposes of risk assessment.

It’s not the largest sample size. Indeed, only 10 borrowers and 11 loan facilities connected the first 18 loan tranches that were either fully recovered or had write-offs, so it could certainly be an unlucky result. Still:

In all the loans that have been recovered or had write-offs, slightly less than half the pound amounts lent were written off. That’s not a good recovery rate, even for development lending, which is riskier after a loan goes bad than many other kinds of lending.

This is very rough, but, on the current trajectory, and after adjusting for the individual characteristics of the outstanding bad debts (which in some ways on average are less risky than the written-off loans) it would therefore appear that an additional £25 million could be written off at some point. That represents about 17% of the outstanding loan amounts.

That’s based on loans CrowdProperty calls bad debts. If we add in more loans that 4thWay estimates will also be bad debts needing recovery, that loss estimate would be some percentage points higher.

Also, for new loans you put money into during 2022 and 2023, you could find that these cohort years each bring losses for the average lender, although those losses should easily be outweighed by your lending in other lending accounts if you have been using essential, basic lending strategies of diversification.

For CrowdProperty loans issued in those years though, after they’re are all repaid or written off, and every penny of interest that borrowers will pay has finally been paid out, losses could be the most common result:

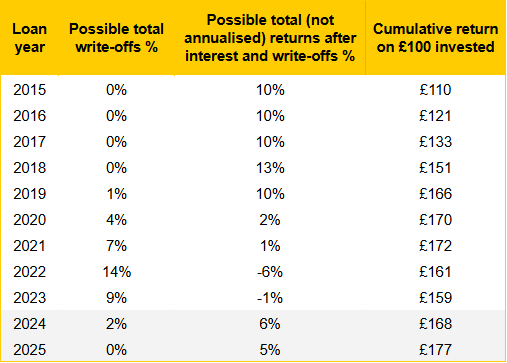

Possible returns or losses by year loans were made

In the table above, the possible total write-offs (second column) as a proportion of the amount lent are extrapolated based on results CrowdProperty has confirmed so far.

Those percentages could improve dramatically if CrowdProperty can demonstrate either a) its data to us has more errors (not impossible although also not great to know), b) that the vast majority of outstanding bad debts have better recovery prospects than prior loans, or c) if it quickly now starts turning many of the outstanding bad debts into full recoveries.

Furthermore, in the worst years CrowdProperty ramped up approving more very large loans. That partly explains why the biggest three outstanding bad loan tranches for the 2021 year represent 39% of the total bad debts. If a few of those recover better than I have modelled, it’ll really help. But:

If my estimates turn out to be even vaguely accurate, lenders will have taken very big hits from loans in 2022. Plus, 2020, 2021 and 2023 were hardly good vintages.

Results will be unfairly distributed based on the specific loans you have lent in through CrowdProperty. If you’re not already having a lot of very lengthy delays or problems to many of your loans or tranches over two years old, you’re likely more in the better half of the loanbook. Lenders who have taken few active steps to diversify will be particularly prone to extremely good or extremely bad results by random chance.

The third column in the above table shows what the typical total return might be on loans lent in during those years when adding in lending interest.

That column takes the possible write offs and adds on interest that has already been paid out to lenders in loans that were issued in those years. It also factors in a conservatively estimated additional amount of interest to be paid on the outstanding loans.

It is not an annual rate but the total return against the total lent.

The fourth column helps you get a rough idea what the outcome might be when all loans are finally repaid or written off. It estimates how the average lender’s pot might grow and shrink, presuming you lent roughly the same amount in new loans each year.

The last two columns both highlight that the returns from loans in 2021-2023 in particular could potentially be very disappointing by online lending standards.

Most lenders lending similar amounts in a similar number of CrowdProperty loans every year since CrowdProperty started can still generally expect their CrowdProperty results to do okay, getting back more money than they started with and still even beating inflation by a few percentage points per year – although not exciting results.

However, anyone lending very heavily in the 2022 and 2023 calendar years compared to any lending they did in other years (if any) should now be prepared for a possible overall loss in their CrowdProperty lending – and not a small one by P2P lending standards.

I think lenders on average might lose 1%-6% of the amount lent in loans in each of those two years, even after accounting for interest that will be paid out on both their good and bad loans in those years.

A 6% loss (perhaps a little less when annualised) is not much when investing in the stock market but it’s more surprising in P2P lending. In a sensibly diversified portfolio of six lending accounts, that could offset roughly a year’s gains made in any one of your other lending accounts.

Give this the perspective it deserves – it’s not so bad for most

Don’t do what many do and be too hard on yourselves when one of your investment decisions doesn’t turn out profitably for a while and don’t knee-jerk react.

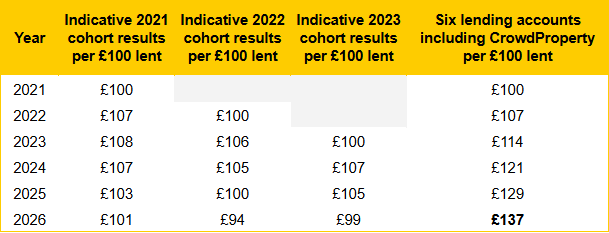

If you lend well diversified across the absolute minimum six online lending accounts, the total impact would probably be the equivalent of reducing your returns over five years by about one percentage point per year:

Lending pot growth or decline

The table above shows that you might expect to get less back than you put into CrowdProperty in new loans issued in 2021-2023, but that your overall lending results should still be positive if you have been spreading fairly evenly across at least five other online lending accounts.

By the end of 2026, your returns after write-offs are still probably around 5.5% to 7% per year, annualised, with a central case of 6.5%. This presumes that you don’t panic and instead continue to lend your money across lots of P2P lending accounts as it is repaid to you.

The figures in that table assume you lend the same amount in each lending account over the years, with no additional contributions, starting in 2021. They are indicative only and take the shortcut of presuming all the CrowdProperty loans from 2021 to 2023 will be repaid or written off by the end of 2026.

If you started lending in 2022 or lent more heavily then than in 2021, or if you had too much money in CrowdProperty compared to the rest of your lending portfolio, then your results could turn out worse than average.

The future for CrowdProperty

Technically it’s too early even to attempt to forecast percentages of either write-offs or lending returns for loans approved by CrowdProperty in 2024 and 2025, especially with its diminished transparency.

Yet in the first table on this page I still included the current write-off possibilities plus a conservative estimate of the returns for both those years – really so that you have something to look at.

Here’s that first table again:

I expect loans issued in 2024 and 2025 to do better than the earlier years, as the economics are improving or have at least been better accounted for from the start.

Plus, the characteristics of CrowdProperty’s loans are shifting to look a bit more like they used to. For example, from 2015 to 2020 it approved just one development facility for £3 million or more. In 2022 to 2023 it approved 26 of those. In 2024, this shifted back down to just one at £3 million +.

Also, sustained higher lending rates will help offset a little of the remaining difference.

Overall, I find now that the lending rates have not quite provided the comfortable margin of safety that I had hoped for and believed existed for loans in those tougher years, when considering the horrendous conditions that the borrowers have been put through.

[Pause for breathe! And then back to the rest of the CrowdProperty Review!]

Wind-down prospects have risen

In my opinion, the risk that CrowdProperty has decided to covertly wind down its online lending platform for individual lenders to focus on institutional lending is currently the greatest than it’s ever been. But don’t confuse that possibility with certainty – it’s a long way from the latter.

A wind down of P2P to shift to other ways to lend is a risk to individual lenders in P2P lending, because the business case for treating individual lenders well after that decision has been made can become weaker.

I’ll come to some counter-arguments in a minute, but here’s a bullet list of some of the circumstantial evidence that CrowdProperty might be considering the switch:

- There’s increasing emphasis on institutional lending in what CrowdProperty says and does.

- CrowdProperty has stated to 4thWay that it has limited need for raising money for loans from individual lenders at this time.

- CrowdProperty says it’s still not doing as much institutional lending as it would like.

- The previous CEO left suddenly. Publicly, at least, he’d always pushed hard for individual lending.

- Its transparency for individual lenders and 4thWay is diminishing, while it prioritises institutional lenders’ information advantage.

- Less support for, or attention to detail when aiding, 4thWay.

- Seemingly sluggish and less urgent action on behalf of lenders, e.g. its statistics tables have been down for a few months now.

One of the seemingly clearest signs that CrowdProperty is already shrinking online lending is, in actual fact, an unreliable measure. Take a look at this:

That table shows that far fewer developments are being funded through CrowdProperty’s online lending platform at present. To add to that, just £34 million has been lent in the past 12 months, down from £107 million two years ago.

However, CrowdProperty is not alone here. At least one near competitor has seen similar reductions in lending.

If CrowdProperty had been alone, it would potentially have been a stronger sign that it was diverting a lot more fresh loans to institutions, allowing the pool of loans on platform to slow to a trickle in potentially a kind of soft, slow, undisclosed shrinking of online P2P lending.

As it stands, the evidence is insufficient to make that assumption.

CrowdProperty explains the market has been really slow, with many borrowers tied up in existing projects, and deals are taking longer to get through the initial analysis phase or into the surveyor stage.

CrowdProperty has halved its borrower-facing salespeople and underwriters due to the slow down, and that halving impacts institutional lending as well as lending from individuals. (It did, however, explain it had other funding lines in the same breathe.)

Furthermore, CrowdProperty has stated that it’s continuing with its online lending side. It also still makes improvements to its website, publishes regular blogs, and it has informed me that any lender can still talk to an executive if you so wish.

Overall, the odds of CrowdProperty choosing to wind down its P2P lending operations have gone up – with some level of risk to lenders if it chooses to do so. But it’s far from certain.

Has CrowdProperty provided enough information to assess the risks?

CrowdProperty continues to provide a huge amount of data, which many peer-to-peer lending companies don’t do.

I have already pointed out that it will no longer provide information, data or documentation on loans suffering issues even though it had previously made commitments to us to continue to provide all the information we need.

This shortfall doesn’t prevent us assessing the risks, but makes us need to interpret the information we have conservatively, by assuming the missing information is negative information.

It also still grants access to its key personnel for interviews. However, it no longer volunteers even more information than we asked for.

As far as potential individual lenders are concerned, it needs to restart its published statistics tables and those need to be at least as comprehensive as before – and fixed, as they too had errors.

While its holding page states that new statistics offering “better insights” in a push to be “more transparent” are coming, we should doubt that claim.

Firstly because it took down its stats on lending returns after losses first, and then the whole table (which admittedly needed some fixing). But also because CrowdProperty has just told me that the statistics are now more complicated due to confidentiality with institutional lenders – and it has already made clear that it will be less transparenr on recovery expectations.

Regarding the information existing lenders get: you get to see some initial documents, but lenders complain to 4thWay about little in the way of updates and tell us those updates are not very forthcoming or punctual in explaining when things are beginning to go wrong and what CrowdProperty is doing about it.

Even though the shortfalls have been an issue for a while now, CrowdProperty told me that it still needs to do research to find out what lenders want in the form of updates. You could have quite a wait for the detailed transparency you want, as they are only now talking about conducting surveys at some point – and institutional lenders apparently get priority of information. That said:

CrowdProperty will still let all individual lenders talk to an executive, if you want to.

Is CrowdProperty profitable?

In a further reduction in information, in CrowdProperty’s latest accounts that were published in December 2024, it removed the opening pages of free text by the CEO on its business, its performance and its strategic review.

While that may be a deliberate decision to decrease transparency, it’s just as possible that it was missed out on that occasion because the former CEO was leaving pretty much around that exact time.

A little history on its profitability:

CrowdProperty roughly broke even in the year up to March 2018 and March 2019 and turned profitable after that.

In 2021 it chose to again operate at a loss, in order to spend more to grow more.

While it continues to put a lot of money back into the business to grow it further, it still managed to make a profit again in the year to March 2023 – a larger one of about £1 million.

….Aaaaand then it made a loss again, in the financial year to March 2024. I think. The filed accounts are highly abbreviated, but it looks like perhaps six-figure losses again. I don’t currently have any information as to why that occurred. However, its balance of cash and debts appeared at that point to be doing just fine.

What is CrowdProperty’s minimum lending amount and how many loans can I lend in?

If you choose loans for yourself, the minimum you can lend per loan is £500. If you use auto-lend, you can lend as little as £50 per loan, although you must contribute at least £500.

Lenders have long complained that there were far more lenders with cash to lend than there was supply of loans to lend in, so that you can usually only lend small amounts.

More recently, a proportion of the lenders are reducing the amount they lend or are even pulling out. These are the lenders who are overweight on loans that are suffering large delays.

However, there are probably a lot of individual lenders still happy to continue and my guess (based on no data, mind) is that the much smaller number of loans being approved mean that competition is still probably very tight for them.

There are now few borrowers and few completely new loans being approved. Most lending that comes available are additional tranches in existing loans to fund the later stages in the same property developments. You’ll need to be patient if you want to drip money in to spread it across enough borrowers and unique loans.

The best way to be sure of taking part in a loan is to use CrowdProperty’s auto-lend feature, which automatically spreads you into each tranche that goes live. However, you’re given just 24 hours’ notice by email to opt out of lending in that tranche.

In that time, you need to attempt to ascertain whether you’re on the verge of being obligated to lend to the same borrower on the same development in a further tranche. If you’re unable to ascertain that information, you should consider opting out just in case.

On the flip side, you can try to top up developments where you’re underweight by lending more manually or by not cancelling later tranches.

Does CrowdProperty have an IFISA?

CrowdProperty’s lending accounts are available as IFISAs.

Can I sell CrowdProperty loans to exit early?

You can’t exit your loans early. You lend until the borrower repays.

You did it!

Well done. I’m very proud of you for making it through this remarkably long CrowdProperty review!

Pages linked to above

Lessons Learned & Improvements To 4thWay Research & Ratings.

4thWay’s 10 P2P Investing Principles.

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.

The 4thWay® PLUS Ratings are calculations developed by professional risk modellers (someone who models risks for the banks), experienced investors and a debt specialist from one of the major consultancy firms. They measure the interest you earn against the risk of suffering losses from borrowers being unable to repay their loans in scenarios up to a serious recession and a major property crash. The ratings assume you spread your money across hundreds or thousands of loans, and continue lending until all your loans are repaid. They assume you lend across 6-12 rated P2P lending accounts or IFISAs, and measure your overall performance across all of them, not against individual performances.

The 4thWay PLUS Ratings are calculated using objective criteria that can be measured and improved on over time, although no rating system is perfect. Read more about the 4thWay® PLUS Ratings.

Our service is free to you. We don't receive commission or fees from the above-mentioned companies. We receive compensation from some other P2P lending companies when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. This doesn't affect our editorial independence. Read How we earn money fairly with your help.

As this latest reassessment was very long in the making, some of the data that was worked on is slightly older than usual being up to around mid-April 2025, but that’s only about six weeks further back than we would ordinarily use and it’s unlikely to be material.