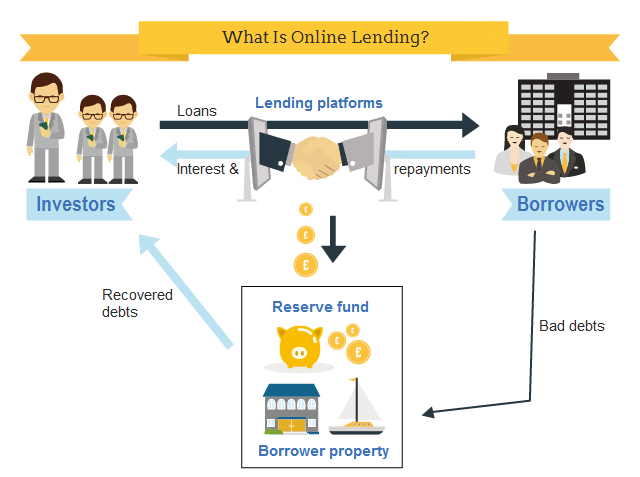

Online lending (often called “peer-to-peer lending”, “marketplace lending” or “social lending”) is about people or businesses borrowing and lending directly with each other, cutting out the banks. Investors get a good return on lending, and borrowers get better repayment terms.

It is online lending platforms that bring the lenders and borrowers together:

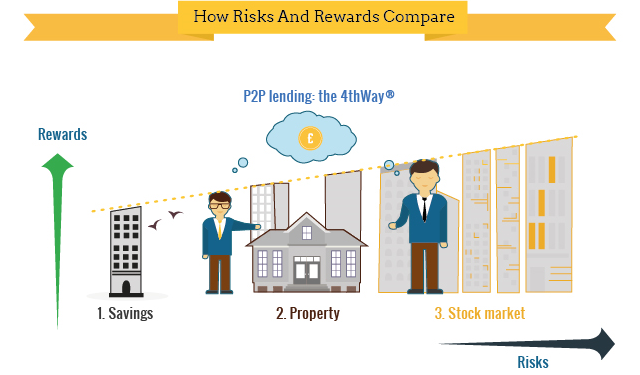

For lenders, the risks are usually lower and the returns far steadier than the stock market, while the interest you earn is far higher than savings accounts:

4thWay® helps lenders make confident lending decisions: while lending platforms check out the borrowers, 4thWay® checks up on the platforms. We see if they have the needed skills, policies and results, and then explain this simply to lenders:

Read more about 4thWay®.