To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

The Hidden Peer-to-Peer Lending Costs

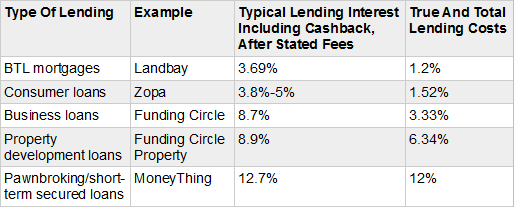

See the hidden costs in peer-to-peer lending on four peer-to-peer lending websites covering five different types of loans. Also read how the overall P2P lending costs compare to other investments.

While many peer-to-peer lending websites (aka marketplace lenders) claim to have no lending fee, and others even claim to be “free” to individual lenders, all of them have hidden costs for individual lenders like you and me.

Similar to traditional investments and investment funds, these costs are hidden in the difference between what the borrower pays and what the lender receives. You can read about these costs in There's No Such Thing as “No Lender Fee”.

Since none of the P2P lending websites are fully transparent with lenders about their costs, 4thWay® attempts to estimate them wherever possible in its detailed comparison pages. Below I show you the latest estimates on some of these costs.

Total costs of lending start from 1.2 percentage points of your interest earned with buy-to-let loans through Landbay* and go up to 12 percentage points for pawnbroking and short-term secured lending on yachts and other items, such as through MoneyThing.

Of the above, just Funding Circle* and Zopa charge specified lending fees or loan servicing charges. Both charge 1%, but hidden costs boost this to 1.5% in the case of Zopa, and up to 3-3% for Funding Circle business loans and 6.3% for Funding Circle property development loans.

The figures above exclude contributions to bad-debt provision funds – reserve funds set aside to pay expected bad debts. Landbay* and Zopa both have these funds and potentially contribute as much as 1% and 2.2% respectively. While that comes out of our individual lenders' pockets on top of the costs shown in the table, it also gets put aside solely to protect us from losses.

Bad debts are not an investing cost. Rather, they are an investing loss. So they are not considered in the above table.

How these costs compare to other investments

The good news is that costs seem quite reasonable overall.

In comparison, most managed investment funds cost from 0%-5% up front and then 0.6% to 2.5% per year. Plus you pay fees to your broker, pension provider or ISA provider on top. Overall, the P2P lenders are probably in a similar ballpark.

As P2P lenders grow they will achieve economies of scale that will allow them to compete on costs with super-low cost investment funds, such as index trackers.

Costs for some kind of lending are clearly considerably higher, such as development loans and pawnbroking. To an extent this is to be expected and accepted, considering the extra costs they have, such as in checking either the borrowers, or the items or property they put up as security.

However, even where higher costs are expected it doesn't mean that the investment is a good one. Costs matter. A lot. So you need high enough interest rates to compensate.

Consider costs versus expected interest

Most of the time, lower-return, lower-cost investments will be safer.

But lower-return, higher-cost investments will be some of the least safe, so make sure that you can still expect to get a high rate of return if the costs are high.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Funding Circle and Landbay, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.