To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

Why Property Development Lending Is Riskier Than Most

We now have around two dozen different property P2P lending websites to choose from and probably around half do property development loans.

Property development lending usually pays you more interest, and with good reason: the outcome of the loan is less certain. Let's look at that uncertainty and what you can do about it.

Over-borrowing

Firstly, compare those loans to a bridging loan on a completed property.

A homeowner or property investor might want a temporary loan if they are buying a new property before they have sold an old one. On selling the old one, they pay off the bridging loan.

A bridging loan, in short, allows people and businesses to temporarily borrow considerably more than they can ordinarily afford.

A property development loan is similar in that the developer might borrow more than the land and property is worth before development starts – and usually does. At the least, the borrower might borrow much closer to 100% of its starting valuation than you normally see with other property loans.

Will it go to plan?

Yet, unlike many other bridging loans, quite a lot has to happen between now and the eventual sale of the development for the developer to be able to easily pay off the debt using the proceeds of the sale.

Assuming the developer got planning permission before borrowing, it still needs to put down foundations, build and sell the property.

Things can go wrong. The ground underneath might turn out to be different to that revealed in their tests. This can add large unforeseen costs and delay the project.

The developer might manage the project badly (which is why you generally lend to experienced developers).

And, between now and the sale, the market might fall away.

Lenders and P2P lending websites also have less data to go on, which makes modelling the risks harder. And, while 4thWay's Chief Risk Modeller wrote the rule book on modelling development loans for a bank recently, most peer-to-peer lending websites themselves don't have any professional risk-modelling capability! (See Leigh Baker's Checklist For Selecting Development Loans.)

What you might like to see

Going back to the point about borrowing more than the starting value of the property, take this CrowdProperty deal:

The development involves the construction of a pair of semi-detached houses on the site of a former pub car park.

The development involves the construction of a pair of semi-detached houses on the site of a former pub car park.- Loan required: £310,000.

- Development costs: £220,000.

- Estimated final property value of of £550,000.

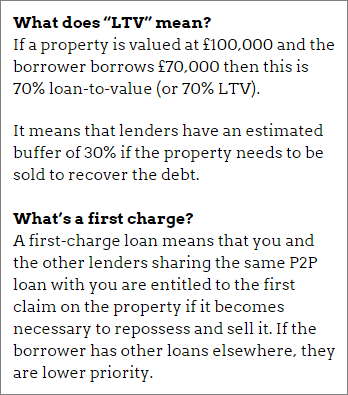

- Loan to value (see sidebox): 56.4% (that's £310,000/£550,000).

- Interest to lenders will be 10% p.a.

- Loan is for 12 months.

- First charge on the property (see sidebox).

The loan is £310,000 and the development costs are are £220,000. Measured against the expected sales value of £550,000, however, it looks quite good. In this development there is a lot of leeway for cost overruns.

What you can do about the risks

But the inherent risk creates this need for us individual lenders to demand drastic measures: such as low loan to values and higher interest rates to compensate for the risks.

The borrowers' experience is very important here. As CrowdProperty writes: “The developer is a family-run business based In Tunbridge Wells, Kent. They are very experienced, having successfully completed over 150 projects during the last 14 years, consisting of extensions, conversions and new build.”

You could lower your risks by focusing on P2P lending websites that select very high-quality borrowers, low loan to values and other demanding criteria, such as CrowdProperty and LendInvest.

Our service is free to you. We don't receive commission from the above-mentioned companies. We receive compensation from some other P2P lending companies when you click through from our website and open accounts with them. This doesn't affect our editorial independence. Read How we earn money fairly with your help.