To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

Crowdstacker: New P2P Business Lending Website

Crowdstacker is a brand spanking new P2P lending website that helps you lend to businesses.

It offers you British businesses that:

- Are well established.

- Have a compelling business proposition.

- Pass Crowdstacker's financial health checks, which includes fraud checks and checks on their market and industry trends too.

- Are run by people with qualifications and experience. Crowdstacker also considers their track record and reputation.

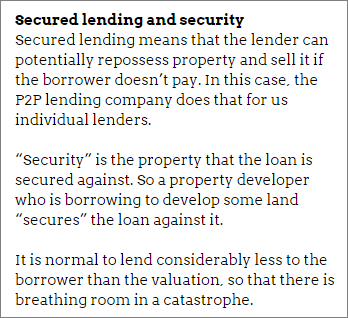

In addition, Crowdstacker might take security (see sidebox).

In addition, Crowdstacker might take security (see sidebox).

Or it might impose restrictions on what the borrower can or can't do.

This might be, for example, insisting the money is kept in an account overseen by an independent administrator.

(Read more on such restrictions in The Biblical Importance of Legal Covenants.)

Who runs Crowdstacker?

Crowdstacker is run by an experienced accountant, an even more experienced corporate lawyer, and a third founder who worked in derivatives and as a fund manager, among other things. Two advisors to the board also add some useful experience.

One missing skill set from the profiles listed is quantitative risk modelling, which helps to evaluate borrowers, set sensible interest rates, decide whether it is appropriate for the borrower to put up property that can be repossessed if the loan goes bad, and such like.

Crowdstacker interest rates and costs

It's far too early to say what the average interest rate will be over the medium or long run, but currently you can earn 6.4% per year. More on that under “Loan selection”, below.

Crowdstacker does not provide enough details for us to estimate your costs, although this is going to be hard even for Crowdstacker to estimate until it has completed a good number of loans.

Like some other P2P lending websites, it says that there are “no fees” for lenders and even “every penny you invest earns interest.” However, lending does cost you money and it always costs you money. Please read There's No Such Thing as “No Lender Fee”.

Buying and selling loans, and leaving early

To exit your loan early, you can sell your loan parts to someone else at a cost of £50, provided another lender wants to buy them.

You probably need to lend closing on £10,000 to the borrower before we could fairly say that those fees were relatively low, since that would bring the total cost to around 0.5% of your loan.

If you sell a £1,000 loan part, that's a whopping 5% fee. But please don't lend more than you should in one loan just to try and get the sales fees down!

Loan selection

There is currently no automated lending feature. You pick your own loans from those that pass Crowdstacker's scrutiny.

At present, since Crowdstacker is brand new, there's just one borrower available to lend to. This is a residential property developer called Quanta, which will use your money to purchase properties for development.

You can lend it from £700 upwards for three years, and it is seeking £3 million in total.

Assuming all goes well with the loan, you'll earn 6.4% interest per year. Crowdstacker says it's 6.8%, but when you convert this to the more useful “compounded” rate – which most P2P lending websites use as standard – it works out at 6.4%.

This is a bit less than you might expect through Funding Circle‘s* developer loans, especially when you consider the cashback it offers. (Read A+ Funding Circle Property, 8% + 2% Cashback!) Funding Circle has the advantage of more than one-year's history doing developer loans totalling over £45 million, with no bad debts and just one late payer so far.

You can also earn higher rates from other new development loans P2P lending websites, such as CapitalStackers and CrowdProperty, which can pay a rather more attractive 10%+.

As is normal for property development, you receive your actual loan back after the project is completed. You receive interest either quarterly or half-yearly.

You're lending to a developer, not becoming one

The website unfortunately describes lending to Quanta like being “an armchair developer”, which is a completely inaccurate description. You're lending to a developer, not becoming a developer, and so the risk-reward profile is totally and utterly different. Lending is both lower risk and lower reward.

Quanta is just one borrower, so don't put all your eggs in one basket. You need to spread most of your money out over other opportunities. Since this is the only opportunity currently available on Crowdstacker, you'll need to look elsewhere for more property P2P lending options.

To find them, read the following:

21 Property Peer-to-Peer Lending Websites

Get Started With The Safest Peer-to-Peer Lending Websites

CapitalStackers: High Property Returns With Lower Risk

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Funding Circle, and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.