Press Release: P2P And Online Direct Lending Returned 5 x More Than Savings Over 10 Years

- Investors in peer-to-peer lending and other online direct lending have more than doubled their money in 10 years, while cash ISA savers grew their pots by just one-fifth.

- Cash ISA savers failed to keep up with inflation, while online lenders comfortably outpaced it.

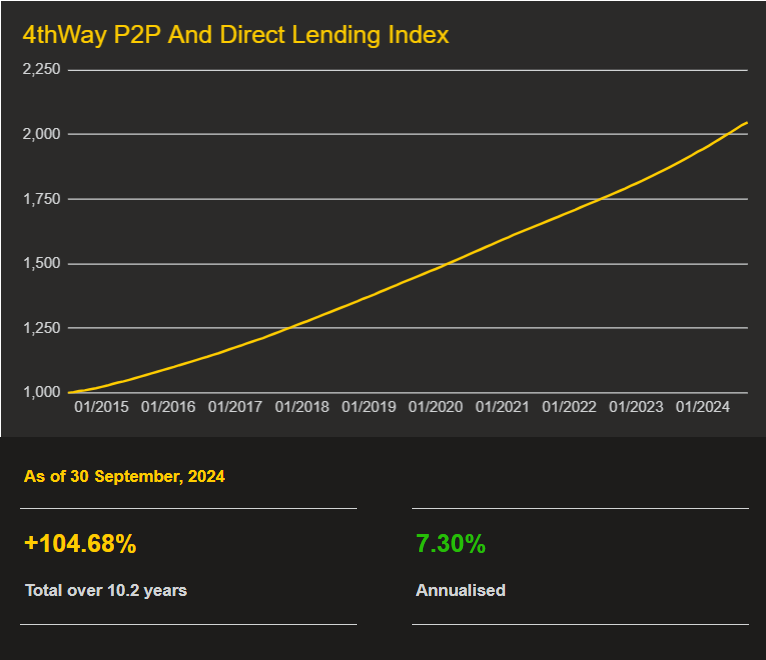

Returns on peer-to-peer lending and other online direct lending have been 7.30% per year after costs and losses since the end of July 2014, according to the 4thWay P2P And Direct Lending Index (PADL) (1). Savers in cash ISAs have made just 1.77% pa over the same ten-year period (2).

Put another way, in ten years, lenders have turned £10,000 into £20,468, more than doubling their money. Meanwhile, savers have turned £10,000 into just £11,956 in cash ISAs.

Furthermore, over the past decade, cash ISA savers have failed to keep up with inflation, losing to it with -16.9%, whereas people lending online have beaten inflation by 42.5% (3).

Both cash ISAs and online lending enable completely tax-free returns (4).

Net Returns of online lending and cash ISAs by full calendar year

| Year | Online lending gains after costs and losses | Cash ISA savings gains | Online lending +/- over savings |

| 2015 | 6.90% | 1.42% | +5.48 pp |

| 2016 | 7.41% | 1.07% | +6.34 pp |

| 2017 | 7.98% | 1.05% | +6.93 pp |

| 2018 | 8.12% | 1.31% | +6.81 pp |

| 2019 | 7.81% | 1.30% | +6.51 pp |

| 2020 | 7.65% | 0.83% | +6.82 pp |

| 2021 | 6.77% | 0.37% | +6.40 pp |

| 2022 | 6.51% | 1.91% | +4.60 pp |

| 2023 | 7.30% | 4.73% | +2.57 pp |

| 2024 to end September | 5.92%* | 3.48%* | +2.44 pp |

*The cash ISA and lending returns shown for 2024 are lower, since it is not a complete year.

10.2 Years of Investment Returns in the 4thWay P2P And Direct Lending Index (PADL)

The Constituents of the 4thWay PADL Index

The constituents’ total lending volume is equal to half the size of the P2P lending market, at around £750 million.

Primary constituents

The table below shows the types of lending available today and the rates currently available for investors who start lending today.

| Provider/ model |

Description | Rates |

| CapitalRise*/ DL (5) |

Prime bridging and development lending with no capital losses | 8.79% |

| CrowdProperty/ P2P (5) |

Mostly development lending with negligible capital losses | 10.12% |

| Invest & Fund*/ P2P |

Primarily development lending, no loans have ever been in serious arrears, no losses | 8.52% |

| Kuflink*/ P2P |

Bridging and development lending, negligible losses covered by Kuflink's stake | 8.75% |

| Loanpad*/ P2P |

Bridging and development lending under 50% LTV, no losses | 6.50% |

| Proplend*/ P2P |

Commercial property lending with investment income, negligible losses | 8.45% |

Rates in the table above were last updated in November 2024. Find out more about these and other providers in the comparison tables.

Neil Faulkner, co-founder and managing director of 4thWay, comments

“While online property lending has stably paid out 6.5% to 8.1% per annum, even through terrible economic times, savings returns have averaged far less while being surprisingly more volatile, considering they are supposed to be lower risk.

“High inflation saw savings rates leap in the past few years, whereas online lending rates had less room to grow, since they are more detached from the Bank of England base rate. However, online lending still remains a solid 2.5 percentage points higher.

“Forecasting is usually a treacherous game, but it’s not hard to work out that the spread between savings and online lending is likely to widen again in 2025, now that inflation is down two-thirds from its peak.

“Since I’m on the subject of inflation, it’s worth noting that savings lost to inflation in nine out of the past ten years, but P2P and other online lending pots grew by less than inflation in just one year.

“Sensible money commentators have always said that peer-to-peer lending is not savings, it is investing. That applies to the risks – but also to the results.

“Savings play an essential role in household finances as an emergency reserve and for shorter-term needs, but the risk of your pot being able to buy you less over time is huge when you deposit much more than that at the bank. If you want to stably beat inflation in the vast majority of years, look into online lending.”

-ENDS-

For further analysis and/or interviews with Neil Faulkner, please email pr@4thWay.co.uk

If you missed it, request our Q2 4thWay PADL Index press release, which addressed a comparison of the stock market to online lending, and touched on topics such as survivorship bias and ethical investing.

4thWay research, analysis and guides

Peer-to-Peer Lending Vs Other Investments.

Why The Best Time To Lend Is Now.

Look Outside P2P Lending: Investing In Shares.

Notes for Editors

1) The 4thWay P2P And Direct Lending Index (PADL) starts from the end of July 2014 and currently goes to the end of September 2024.

2) Based on Bank of England data on savings deposits into one-year, fixed-rate cash ISA deals, including unconditional bonuses. BoE data shows one-year cash ISA deals have paid out more than one-year fixed savings account rates in all but five months since the start of the PADL Index. One-year cash ISA deals have also returned more than two-year cash ISA deals over ten years.

3) Inflation adjustment is based on what is widely considered to be the most accurate measure of inflation, the CPIH index.

4) The IFISA wrapper shelters individual lenders from taxes in the same way cash ISAs do. (By the by, both savers and people lending online are entitled to various substantial tax breaks and reliefs even outside of ISAs, such as the personal savings allowance, which applies to saving and online lending. In total, it means that most people won’t have to pay taxes even when using ordinary savings or lending accounts.)

5) “P2P” means the platform model is based on article 36H P2P agreements. “DL” means the platform operates using one of several other direct lending models, or models that effect the same for investors.

About the 4thWay PADL Index – Methodology

Using detailed data from the lending platforms, 4thWay takes the way many bond indices are calculated as a minimum standard and improves on that by using intra-loan events, such as additional default interest paid out to investors, and actual cash flows where possible.

Bond indices typically take the amount, rate and term, and extrapolate the amount made by investors based on generating a schedule, while marking down bad debt as it is written off or charged off.

About 4thWay® – P2P lending research approved by your peers

4thWay® is an independent ratings and research agency for the peer-to-peer lending and other online direct lending markets that helps investors compare the many risks and aspects of lending. We uniquely have the full range of skills to research opportunities in this sector, and provide unbiased P2P lending comparisons, calculated ratings and performance indices, all available at 4thWay.co.uk.

Our mission is to be the most trustworthy source of information for P2P investors in the UK – which is why we hold ourselves accountable to our users, who govern us through a Panel of Peers, ensuring we always stay focused on individual lenders interests in this thriving market.

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.