To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

New Mintos Offers Great Autolend Options

Those of you who like to take a bit more risk might try P2P lending company Mintos.

Key risks

It's riskier because it's new, having started in September 2014.

It's also riskier because, well, it's based in Latvia, so I don't know much about how well its country protects lenders like you and me.

By which I mostly mean I don't know if their laws and regulations make it's easy for us to chase borrowers who don't pay and take their properties off them. (I'll ask Mintos and other sources about it and write a follow-up article.)

Then there's the additional risk that you'll get less back than you expected due to lending in euros.

Finally, there are no real details about the standards Mintos sets in choosing borrowers. Borrowers need to have a stable income, own a property and be at least 21. That's a good start, but it's literally all I know about them.

All that said, this European P2P lending company talks a good game. It comes across a serious team with plenty of experience in the right areas, and enough money to really take off.

Money that you have deposited but not lent out is kept in a separate bank account, but the account is in Mintos' name “for the benefit of” its lenders. In the event Mintos itself goes into debt and its own lenders come knocking for repayment, this doesn't sound as safe as a UK segregated client account, but the risk is still, I guess, not large.

About the borrowers and the loans

Mintos' borrowers are residents of Latvia – although its lenders can be residents in the UK and the rest of the EU.

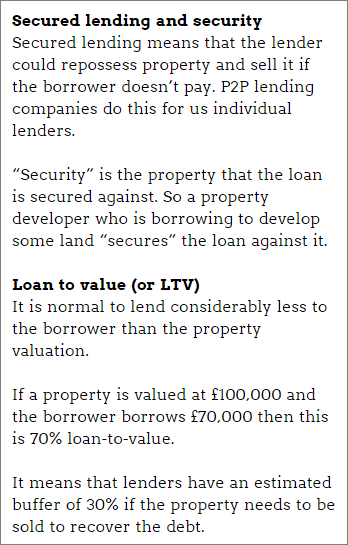

The website has completed  €670,000-worth of loans, secured against €2,170,000 of residential property. That's an average loan-to-value of 30%.

€670,000-worth of loans, secured against €2,170,000 of residential property. That's an average loan-to-value of 30%.

Borrowers can borrow up to 90% of the value of the property, but the vast majority of the loans listed at the moment are for less than 50%. Loans are from three years to 10 years.

The loans are from €10,000 to €100,000, which shows how cheap property in Latvia is compared to Blighty and Northern Ireland.

A vital key question that Mintos' website did not answer is whether these borrowers have other debts and whether we lenders will be first in the queue to recover our money, e.g. if a property has to be sold to do so. (That's another question I'll put to Mintos and get back to you on.)

There are 78 loans currently running. 71 of them are going smoothly and 7 of them are behind on their payments by no more than 15 days. There have been no bad debts, but it's early days.

Borrowers are charged 8% to 18% per year plus a fee of 1% to 5% of the loan up front. To put that in perspective, a three-year loan at 18% with a 5% fee is the equivalent of 22% APR.

Lender interest and costs

Lenders get “up to 15%”, although you also pay 2% of the amount you lend each year to Mintos.

Note that our fees are not linked to success. We pay Mintos even if we lose money.

Mintos doesn't share the average total costs for borrowers or the average interest earned by lenders. The difference between the two figures are the lenders' true and total costs of lending, so we can't tell you what your full costs are.

In that regard, Mintos is just like every other P2P lending company: not as transparent on costs as we'd like.

You can choose loans yourself or use auto features.

Choosing loans yourself

When choosing loans for yourself, you get to see:

- The loan-to-value.

- How much you can lend.

- The interest rates.

- Where the property is based.

- What it is (e.g. a house or apartment).

- How long the loan is for.

You can also filter the list based on the purpose of the loan.

There is a secondary market, where you can buy loan parts off other people. These can be sold to you for the same price, or for a premium or at a discount. So, if someone has lent €100, they can try to sell it to you for €104. If the interest rate is high enough, you might take it.

Since it costs 1% of the amount sold when you sell on the secondary market, you can expect many sellers to try to raise their price a little. Right now, there appear to be a lot of lenders playing the game of buying loan parts and then putting them on offer at a 10% to 20% premium straight away, to try and make a quick fat profit.

There are lots of automation options

Just like many other P2P lending companies, you can automatically lend your money based criteria you set.

Some of its automated options are really interesting.

You can choose a minimum interest rate, which is standard wherever a P2P lending company offers automation options.

You've got a fantastic, unique (as far as I know) automation option: you can specify the maximum amount that will be lent in one loan. So you might want to autolend €2,000 but lend no more than €20 in one loan.

At present, there aren't enough loans to lend €2,000 in €20 chunk – but nearly. There are 76 loans listed at time of writing, which means €26 per loan.

The lowest you can go is €10 per loan.

Another great, unique automation option is to set a maximum LTV. You could say that you don't want to lend to a borrower unless the loan-to-value is below 60%. Or 40%.

You can also decide how long you want to lend for and many other automation options.

Commission: we don’t receive any commission from any of the P2P lending companies mentioned in this article for publishing their calculated 4thWay® Risk Ratings and our editorially independent 4thWay® Insight Reports, which are our own proprietary research products to help individual lenders like you make good investment decisions. We do not take commission for including P2P lending companies in our free comparison tables. All P2P lending companies will be included over the next few weeks. Learn How we earn money fairly with your help.