To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

Safest Peer-to-Peer Lending Interest Rates in Mid-January

Some peer-to-peer lending companies have had zero losses to lenders. They all have funds set aside to cover expected bad debts. And they have other protections, such as lending against property that can be repossessed if necessary.

Of those, the ones that have the best 4thWay® Risk Ratings feature in this article. We have also limited the list to P2P lending companies that are easy to use and at make it easy to spread your money across lots of borrowers.

You also just need £10 to get going.

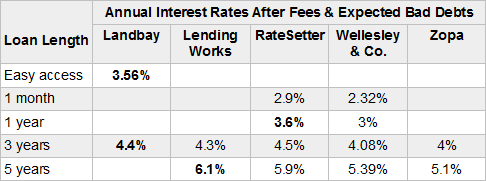

Although they have excellent records against any losses they are still collectively paying excellent rates that far exceed savings accounts or cash ISAs. Here are peer-to-peer lending interest rates on offer at these companies:

Interest rates from the P2P lending companies with the safest records

Note that Wellesley & Co. also offers savings bonds that are not peer-to-peer lending products, but 4thWay founder Neil Faulkner expect that the Wellesley bonds will be higher risk than their P2P lending offers.

The winners

Landbay's easy access account still pays the best for lending up to two years and it nearly matches the best at three years. The 3.5% it pays is vastly more than easy-access savings accounts and cash ISAs, and just shy of RateSetter‘s three-year rate of 3.6%.

Landbay is a P2P lending company that allows you to lend to high-quality buy-to-let borrowers.

Lending Works has the best five-year lending option at a massive 6.1%, which is extraordinary for the low risks involved. Not a single borrower has gone bad out of 1,000 loans through Lending Works to “super-prime” consumers.

About the interest rates

You've got to re-lend any repayments you've got if you want to keep earning interest on all your money. Most of the time you can re-lend swiftly, but delays will mean you'll earn less interest than you expected.

Wellesley & Co. is an exception in that it pays you interest from day one and keeps paying even when your money is not being lent out.

Wellesley's and Landbay's rates look different on their websites because they calculate them in different ways. We convert them all to the same calculation to make it easier to see how they really compare.

The 4thWay® Risk Ratings were devised by experienced investors and a debt specialist from one of the major accountancy firms. The score is calculated using objective criteria that can be measured and improved over time. No risk-scoring system is perfect, not least because we rely on accurate and timely data from the P2P lending companies and the P2P lending industry is relatively new, so there is less information to base a score on. Read more about the 4thWay® Risk Ratings.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Landbay, Lending Works, RateSetter and Wellesley & Co., and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.