To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

Is Lending Works Still A Good Investment?

Lending Works has adjusted its forecasts of lender returns and bad debts for new loans. It's increased the amount of borrower payments that now cover bad debts, with lending rates remaining attractive in its highest-paying account. All this has taken place after hiring a new Head of Risk.

But what evidence exists to show that bad debts are now covered properly, and that lenders in future would not face reductions to interest again, under similar circumstances to those we saw in December 2019? And how might Lending Works* now manage during a downturn?

Lending Works' current forecasts of lender returns

If you read Jane's article, More On Lending Works' Lower Interest Rates, you'll see she's looking mostly at the past. She writes about how Lending Works has had to adjust existing lending rates downwards, as it had underestimated the size of bad debts.

I'm writing about the future. So, that's 2020 loans and beyond, but also I'm overlapping Jane with the 2019 loans, since the bulk of those were still outstanding in the first month of this year. (Whereas 2018 was already over half repaid.)

Here are Lending Works' forecasts of lending results:

Source: Lending Works. “Year of origination” means the year the loan was issued. “Lending capital” is the money lenders have put into lending accounts with intent to lend.

Focusing on the latest forecasts, the Growth Account lending rates (shown in pink) for loans issued in 2019 (the last column) are now expected to be 5.3% per year. Flexible Account lenders (purple) are expected to earn 3.8% per year on 2019 loans.

It's not shown, but lenders in 2020 loans are currently projected to earn 5.3% and 4%. So basically the same, only without setting expectations too high from the beginning.

The lending returns from 2014 to 2019, which are after bad debts have been accounted for, are in line with modern banks' profits on personal loans over recent decades. So, Lending Works itself is expecting that lenders will continue to be fairly rewarded.

Some people will earn less and some more, because these are just averages and there can be a spread between individual results (as Jane wrote).

An aside on COVID-19

Just a quick aside: Lending Works hasn't adjusted these forecasts yet based on COVID-19. The point of this article is not to get into the impact of the global health crisis on your savings accounts, investments or lending returns, but to compare how accurately Lending Works is now able to forecast the normal rewards available – and the normal amounts of losses – compared to how well (or poorly) it did in the past.

So it's a like-for-like comparison. Is Lending Works now getting the always important baseline forecasts correct?

Forecast losses from bad debts

Lending Works has lowered lending rates compared to the past as its understanding of its borrowers and bad debts has improved significantly.

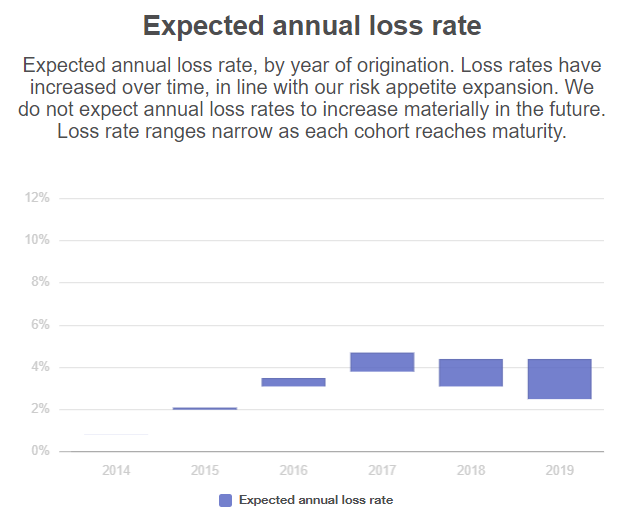

Lending Works* recently started showing forecast losses on an annualised basis – a change from its previous forecasting method. Here are the figures:

Source: Lending Works. “Year of origination” means the year the loan was issued. A “cohort” is made of all loans that were issued in the same calendar year.

Losses for loans made in 2014 were 0.8% annualised and in 2015 will be either 2% or 2.1% annualised.

For later years, which still need more time to mature, losses will be as high as 4.7% per year, according to its forecast of the loans issued in 2017.

But that's the past and I'm looking to the future. (Although I will come back to the reason for higher bad debts in its later years. It is relevant.)

If Lending Works' most optimistic forecasts come to pass, they'll be as low as 2.5% per year on loans issued in 2019, and could be as much as 4.4%.

Lending Works is planning for more bad debts

The bottom line is that Lending Works* is now planning for more bad debts than it used to. It's always good news when a peer-to-peer lending company prepares for worse results, as it means that the expected lending results in the first graph already take higher expected bad debts into account…

Previous forecasts underestimated bad debts

…What's even better is when the forecasts are also reasonably accurate. In Lending Works' case, this would be somewhat of an improvement on the past.

Lending Works' older forecasts are no longer publicly available. What's more, they were calculated differently. They weren't on an annualised basis. Instead, the forecasts were for the total expected losses on the loans issued in a calendar year, regardless of when those loans turned bad and how long it takes to pay them off.

For example, if £1,000,000 in loans took three years to repay and £50,000 of those loans are now either in trouble or have been written off, the total bad debt is 5%. (£50,000 divided by £1,000,000.)

Since it's the total losses that occur over all the years the loans are outstanding, it's not an annualised rate.

So, here are the forecasts of total bad debt for each annual cohort that was made by Lending Works* at the start of the following year, versus what has actually happened so far:

| Year | Forecast | Actual results (so far) |

| 2014 | 1.54% | 1.13% |

| 2015 | 1.47% | 3.73% |

| 2016 | 2.40% | 6.23% |

| 2017 | 3.80% | 7.20% |

| 2018 | ? | 5.00% |

| 2019 | ? | 1.25% |

Lending Works stopped its forecast of total bad debts after 2017, switching instead to the much more sensible annualised forecasts. This makes it easier for lenders to understand and to compare to the annualised interest they've earned.

You'll notice in the table that there's a big difference between the forecasts and the actual results so far. Now, it's inevitable that forecasts will be wrong. If you could predict the future precisely, you could always avoid lending to borrowers who are going to fall into trouble.

But the scale of error in some of these forecasts is certainly larger than 4thWay's experienced bank specialists have often seen in established banks. Loans issued in 2016, for example, are suffering bad debts that are four percentage points higher than expected.

Why did Lending Works get it wrong?

Forecasting in the early years is often problematic. It's not easy for most peer-to-peer lending platforms when they just get started. One of the key questions our bank risk specialist Leigh Baker likes to ask P2P lending companies is: “How do you do empirical models with no history to begin with?”

In other words, how can you forecast what losses are going to be when you have no history of loans to base it on? While there are workarounds for platforms to get going reasonably well, it's the key weakness of many P2P lending start-ups.

Now the important bit: how reliable are Lending Works' new forecasts?

The rest of this article is about my search for evidence to support or disprove that Lending Works has now got a grip on forecasting and therefore setting lenders' expectations correctly with its new target lending rates.

Having a history is a huge start

Lending Works* is now past the most difficult early phase as a peer-to-peer lending platform. The phase that, in Lending Works' case at least, lead to forecasts of 2.4% bad debts that turned out to be 6.23%.

That forecast happened when just 1,600 loans had reached their final payment date or repaid early.

But now 13,000 loans have reached that point, and thousands more are over half repaid. This is a useful little history to start basing decisions on. Leigh no longer needs to ask the question about where Lending Work gets its empirical models; Lending Works makes them itself using the actual borrower profiles that it's been approving.

2017-2019 results are stable

Looking at the second graph in this article, you'll see that losses are expected to be up to 4.7% in 2017, and 4.4% in both 2018 and 2019. Steady forecasts, showing a levelling off. And they are gradually solidifying – changing from forecast to reality. Here's that graph again to save you time scrolling up and down:

The losses it now forecasts are substantially higher than the years 2014, 2015 and 2016.

At first sight it appears to mean that the first three years of Lending Works' history is not relevant any more, because it must have changed so much.

But what actually happened was that Lending Works* simply grew.

Lending Works approved 1,000 loans in 2014 which grew to 2,500 by 2016. In 2017, it approved far more, at 6,600. Each year since it has grown steadily, reaching 9,200 in 2019.

Tiny, new peer-to-peer lending companies can more easily select the best of the best borrowers, since they begin with very little lender money to deploy. Bad debts can start off ludicrously low as a result, such as in Lending Works' first year. As more lenders come along, and the P2P companies broaden their loan approvals to more borrowers, bad debts rise.

Bad debts are levelling, despite continued growth

Since 2017, Lending Works has continued to grow the number of loans it approves in a year, but without bad debts rising any further. This shows maturity in its understanding of its borrowers and the risks involved.

Or so Lending Works says. But does its results so far in the most recent annual cohorts of loans support its latest forecasts?

I took a look back at how 2017 to 2019 cohorts have performed when they were the same age, i.e. after the same number of months had past for each cohort.

In personal loans, the total proportion of loans that have turned bad rises as the months go on. So you can forecast future performance by comparing each cohort after the same period of time.

(This is the so-called “default curve”. That's a particularly suitable expression in personal loans like these, because bad debts tend to hit harder at the start of a cohort and then slow down and level off as the months go on.)

I found that the 2017, 2018 and 2019 cohorts follow a pretty narrow, similar path. At nearly two years into the 2017 and 2018 cohorts, they both had the same level of bad debts. The 2019 cohort has had less time to mature, but at the start of this year it, too, is in line with where the 2017 loans were at that point in their “lives”.

That Lending Works can continue to grow the number of loans while maintaining the same standards is a strong sign that it's been able to dig deep into its historical loan book to learn and make better, more consistent decisions.

Not all plain sailing

But my assessment is not all plain sailing for Lending Works. The number of loans that turn bad in a year, versus the number of loans that were outstanding at some point during the same year, has risen.

It's on the higher side compared to some more cautious high-street lenders, including HSBC. Lending Works' borrower interest rates sufficiently compensate for this, but it's certainly a little something for 4thWay to keep track of for you.

A new face and a fresh start

Inês Maia took over as the key decision maker on Lending Works' loans early last year.

Inês Maia took over as the key decision maker on Lending Works' loans early last year.

It always takes a while to analyse what's going on when you start somewhere as a new Head of Risk, which is why her forecasts and all the changes to lending rates didn't get put through till the end of last year.

She has ten years' experience in this space, including many years in managing the risk of bad debts for individual borrowers at TSB, which was formerly part of Lloyds Bank, and prior to that at Cofidis.

Lending Works* is her first position at the top job, but her experience is nevertheless highly appropriate and is a significant boost to Lending Works' existing team.

It's always easier to wipe the slate clean with someone new, who can take a fresh look at previous missteps without feeling culpable herself. It's a good time to step up lending standards and improve procedures all round. So in a big way, it's reassuring that this has all happened.

How is Lending Works paying for higher bad debts in future?

While past lenders have now had to accept reductions to the interest rates on their existing loans, Lending Works* needs to do better in future at covering a normal level of bad debts without asking lenders to take another substantial hit. Because it's not as if we've just been through a bad economy.

Here are the three things it's done:

1. Steadying its bad-debt levels

All things being equal, as I've stated above, it has steadied the default curve. This is the hardest thing to do when growing rapidly.

2. Boosted borrower rates

Ultimately, bad debts are covered by the interest and fees paid by borrowers.

Borrowers are now paying over 14%, on average. These rates are up 1.9% to 2.7% on about a year ago, and we've been assured the extra interest is all being added towards existing coverage of bad debts.

Borrower rates had been going up steadily since 2017 (while bad debts didn't). Indeed, typical borrower rates are substantially higher today than in 2017, showing Lending Works prices borrower interest rates better.

3. Lender rates are down

The final step in the strategy is to lower lender rates by around 1.2%.

Between both higher borrower rates and lower lender rates, this could mean an annualised boost to existing bad-debt coverage of over three percentage points.

Our estimates are backed up by other figures that have been published by Lending Works* over the past four months, showing, by another measure, that bad-debt coverage has more than doubled. It's a huge jump.

While explaining Lending Works' increased bad-debt coverage, I've been gingerly trying to avoid too much mention of the mechanism Lending Works uses to cover expected bad debts. Because Matt covers this in a separate article: Lending Works Shield: How The Reserve Fund Has Radically Changed. It's a must read.

Reductions in future will be fairer

If, even after all these changes, there still isn't enough cash to cover bad debts, reductions to lending rates will be fairer in future, because they'll be done once every three months (when necessary).

Instead of hitting lenders years afterwards with substantial adjustments, they should be smaller and better distributed between lenders.

For those who lend and re-lend for several years, through thick and thin, any adjustments should balance out fairly between you and other lenders over time.

Lending Works' 4thWay PLUS Ratings

We regularly conduct analysis against the performance of P2P lending and IFISA providers' full book of loans.

Our standard analysis is based on a stricter version of the stress tests that international banks are required to do on their lending portfolios.

These tests model what might happen in a severe recession or property crash: will the interest earned and other defences prove sufficient to protect patient lenders who adopt sensible strategies?

In Lending Works' case, we estimate that a severe recession could mean a tripling of bad debt. It's going to cut it very fine, but our best calculations suggest that, under such circumstances, Lending Works should breakeven or maintain a very small profit on its Growth Account.

Since this is remarkable for any investment, Lending Works* still maintains a 3/3 “Exceptional” 4thWay PLUS Rating on its Growth Account.

The Lending Works Flex Account still does admirably well, now comfortably earning a 2/3 “Excellent” 4thWay PLUS Rating, down from 3/3. This means 4thWay projects lenders will temporarily lose money in a severe recession somewhat equivalent to 2008, but not in a less severe, more common recession.

Don't forget that the 4thWay PLUS Ratings assume you lend in a basket of rated lending accounts, not just one of them. Our ratings are not guarantees in terms of an individual P2P lending account or IFISA, and we assume some will, at times, underperform, especially within lenders' own unique portfolios of loans. You need a basket of PLUS-rated accounts to balance your lending portfolio if you want satisfactory results overall.

That said, lenders who re-lend regularly – and most do – and who commit to keep lending through any recession and all the way out the other end of it, will dramatically reduce the chances of losing money. (The inverse can also be true. Those who panic and try to get out earlier are more likely to cause themselves problems, including locking in losses that should have been temporary.)

Growth Account rewards and risks are better

It's an odd feature of some peer-to-peer lending that lower-rate accounts come with higher risk. That's the case here.

With Lending Works' recent changes, risks have shifted more towards the Flexible Account from the Growth Account.

Jane gave an example in More On Lending Works' Lower Interest Rates:

Lending Works has told us that reductions are linear. This means if you had a loan paying 4% and another lender had a loan paying 5% from the same year, both of you would face the same reduction.

So, if the reduction is one percentage point, you'll now be on target to earn 3% and 4% respectively over the remaining life of that loan.

Therefore the actual reduction should be the same for all accounts.

You have had your annualised rate on that loan reduced by one-quarter or 25% (1 divided by 4 = 0.25 or 25%). Meanwhile, the other lender I mentioned has had her rate reduced by one-fifth or 20% (1 divided by 5 = 0.20 or 20%).

This means that, as things stand now, lenders in the Flexible Accounts would start to incur losses faster than lenders in the Growth Accounts.

Previously, Lending Works was going to pool all loans and interest in the event its Shield fund proved insufficient. This means that both Growth and Flex account holders would reach a 0% interest rate at the same time.

Back then, the advantage was still a little bit with the Growth Account, because you'd earn higher interest to begin with and offset morek losses. But now the emphasis has grown.

How Lending Works will perform in future?

Lending Works' new forecasts are likely to prove much more realistic. It's now forecasting bad debts in 2018 and 2019 to more or less equal 2017, which was a high point in bad debts. Short-term economic events aside, those forecasts look reasonable based on the evidence.

I think we'll now see the start of Lending Works 2.0. Greater expected bad debts are already priced into the interest rates lenders are earning. And those bad debts are priced into the extra cash being made to cover them, which comes from borrowers who are now charged higher rates.

The other articles in this series are:

Lending Works Update: March 2020 Summary.

More On Lending Works' Lower Interest Rates.

Lending Works Shield: How The Reserve Fund Has Radically Changed.

Read the Lending Works Review.

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.

The 4thWay® PLUS Ratings are calculations developed by professional risk modellers (someone who models risks for the banks), experienced investors and a debt specialist from one of the major consultancy firms. They measure the interest you earn against the risk of suffering losses from borrowers being unable to repay their loans in scenarios up to a serious recession and a major property crash. The ratings assume you spread your money across hundreds or thousands of loans, and continue lending until all your loans are repaid. They assume you lend across 6-12 rated P2P lending accounts or IFISAs, and measure your overall performance across all of them, not against individual performances.

The 4thWay PLUS Ratings are calculated using objective criteria that can be measured and improved on over time, although no rating system is perfect. Read more about the 4thWay® PLUS Ratings.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Lending Works and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.