To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

More On Lending Works’ Lower Interest Rates

There's a lot to update you on with Lending Works again, which has been split between several of us to write up. In this article, I'm tackling the nitty-gritty around the reductions to lending interest rates on loans issued in 2019 or earlier.

To see the main article that links all our articles together – which also has a simplified summary for the impatient – please go to Lending Works Update: March 2020 Summary.

Have any lenders lost money at Lending Works?

For me, what was most important was to establish first and foremost whether the changes mean any lenders have now lost money.

According to Lending Works*, no-one has come close to losing money. Indeed, even if Lending Works had not contributed some of its own money to cover some bad debts, all lenders would still easily be covered.

This is backed up by the results 4thWay's specialists have seen using Lending Works' detailed data. Lender interest and payouts from the reserve fund have had losses well covered.

Officially, there's 1/13th less interest going to existing lenders

Lending Works* has claimed that the average reduction in lending interest rates on loans issued before 2020 has been from 5.2% to 4.8% on an annualised basis. Its claim means lenders are now expected to earn, on average, 1/13th less interest than they expected.

(5.2% minus 4.8% is 0.4%. 0.4% is 1/13th of 5.2%.)

Please take good care to note the definition of annualised basis in the hover-over popup. Because that will help begin to explain an apparent reduction for some lenders to near zero interest. More on that later!

More detailed figures paint a picture of some larger reductions

I haven't seen how Lending Works calculated the average 4.8% per year figure, but I have seen other figures breaking down results across different annual cohorts.

These other figures show that between 17% and 23% of lenders will face reductions in your overall annualised rate since you started lending of between 1/5th and 3/10ths.

In other words, the reductions for some lenders are 3-4 times larger than the headline figure, spread over the entire time that you have been lending.

This excludes any re-lending you have done in loans issued in 2020, which are unaffected.

Newer lenders appear to be the hardest hit

If you just started lending in 2018 and 2019 (although not 2020), 23% to 30% of you are now facing a reduction of 1/5th to 3/10ths on your overall annualised rate.

You're the worst hit, because your reductions haven't been offset by interest earned in earlier years on fully repaid loans. Your loans also require larger top-up contributions to cover bad debts.

Any re-lending you do on loans in 2020 has been unaffected.

Without seeing how Lending Works* calculates the information that it has supplied to us, my own calculations above could be off. But not that far off! What is certain – what my main point is – is that many lenders are doing considerably worse than dropping just 1/13th of their expected interest. That's clear from the data I've seen.

Lenders who lent in the early years have profited the most

If you lent in loans issued in 2014-2016, you probably have seen something closer to the 1/13th reduction in interest. These loans have been much less affected by the rate adjustments. And that helps support your overall annualised lending returns since you started lending.

How ISA lenders are doing

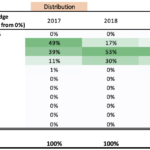

Click on the image below to see a representation of some of the data we've received from Lending Works. It shows the results for people who have been lending through Lending Works' IFISAs:

The chart you clicked on is showing you what ISA lenders have earned, or are on target to earn, compared to the expected amount.

For example, take a look at where it says “Upper edge 80%, lower edge 70%” – and in the 2017 column the “answer” is 11%. (Three columns in and four rows down.) That means that 11% of all the lenders who lent to borrowers that borrowed in 2017 are on track to earn more than 70% of the initial, target lending interest rates. But no more than 80%.

Now, there's actually good consistency in the Lending Works' results shown there. Which I'll get to later. But I'm focusing on the negatives right now. Or, put another way, I'm focusing on the divergence between the headline drop in rates from 5.2% to 4.8% compared to many lenders' actual experience.

No ISA lenders earning every penny they expected

The top line of data in the above chart shows that no IFISA lenders (“Total 0%”) is earning every penny expected. So no-one is earning 100% of the target lending rates any more (rounding errors aside). In other words, if you lent at 5.2%, you're definitely not getting that much now.

The next line shows what proportion of lenders are on target to earn over 90% of the target interest. So, if you have any loans outstanding that were issued in 2017, you could be among the one-in-two lenders (49%) who are earning over 90% of the target lending rates on all the loans you ever lent in from that cohort.

If you started lending in 2019, you're most likely now on track to earn between 80% and 90% of the targeted lending rate. Because that's the case for nearly two-thirds of lenders (64%) in this cohort.

So, loans paying you 5% will be paying you 4% to 4.5% interest on an annualised basis. (Again, if your own results in your online Lending Works* account makes it look like you're earning less, keep reading. It's nuanced…)

Even if you started lending before 2019, you'll likely have re-lent money in loans issued in 2019, so you'll be impacted, if not quite as severely due to interest you've earned before.

30% of the lenders who lent in 2018 will see the interest earned on those loans drop to as low as 70% of the target lending rate advertised at the time.

How Classic Account lenders are doing

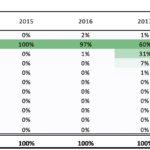

It's a very similar story for Lending Works' Classic account lenders (non-IFISA lenders):

The chart show that probably around 2% have earned 100% of the target rate (i.e. you got every penny of interest you were targeted to get). It's likely that the lucky ones had no loans from those years outstanding at the time Lending Works adjusted rates.

You have a 60% chance that your lending in loans issued in 2017 will be earning over 90% of the target rate, while you've got nearly a one-in-three chance (28%) that your loans issued in 2019 are now on target to earn between 70% and 80% of the planned lending interest.

A very small minority of unlucky lenders will now earn less, although all are expected to get over 60% of the target rates that were initially advertised.

Flexible Account holders of 2019 loans likely worst hit

I'm looking now at Flexible Account lenders versus Growth Account lenders. If you mostly have loans from the 2019 cohort, it's likely that you've been worse hit if you use the Flexible Account. At least – by one measure.

Lending Works has told us that reductions are linear. This means if you had a loan paying 4% and another lender had a loan paying 5% from the same year, both of you would face the same reduction.

So, if the reduction is one percentage point, you'll now be on target to earn 3% and 4% respectively over the remaining life of that loan.

Therefore the actual reduction should be the same for all accounts.

You have had your annualised rate on that loan reduced by one-quarter or 25% (1 divided by 4 = 0.25 or 25%). Meanwhile, the other lender I mentioned has had her rate reduced by one-fifth or 20% (1 divided by 5 = 0.20 or 20%).

Looking at Lending Works' published data, my waffling above appears to hold out.

I see that it's now expecting lenders to earn 3.8% on their 2019 loans in the Flexible Account. On its Growth Account, it's expecting 5.3%. Both of those rates are exactly 1.2 percentage points below the average target lending rates that 4thWay recorded for Lending Works during 2019.

Flexible Account lenders were targeting 5% and Growth Account lenders 6.5%.

In earlier years, the reverse might be true

Strangely, though, this doesn't work when you go much further into the past.

I think this is because, for most of Lending Works' existence, its Flexible Account was actually a three-year lending account. Its Growth Account was a five-year lending account. Back then, loans in each account typically had different lengths.

With the shorter-term accounts, more loans will already have been paid off – and at the initial, target interest rates. Therefore, the impact of what's left is smaller. This also bears out in the information provided publicly by Lending Works* on its current forecasts and in 4thWay data on the initial target rates.

For example, in 2017 the average target rates were around 3.8% and 4.8% for the Flexible and Growth Accounts. Now, lenders are overall expected to earn 3.7% and 4% respectively. That's a smaller drop for the Flexible Account holders.

In other words, those with longer loans – Growth Account users – have borne more of the brunt of the reductions.

Everyone's results are unique

Depending on exactly how much you lent in loans issued in each year, what target rates you lent, and how much of those loans are already repaid, you'll find a completely different blend of results for each lender.

This is no different to most peer-to-peer lending platforms, whereby results vary depending on the loans you're in. This variation has come unexpectedly though for Lending Works lenders. Notice that all the variation in results are on the downside versus the initial target rates.

Each loan you hold will be hit differently, depending on the target lending rate at the time you lent, how much of it is still outstanding, what year the borrower borrowed, and possibly even when you lent.

To take a worst-case example, I poured through past Lending Works lending rates collated by 4thWay.

I saw that in June and July 2017, the Flexible Account was advertising rates as low as 3.3%. If you're one of the very unlucky 1% of lenders in that cohort who earned potentially as low as 60% – or nearly that low – you might now be earning as little as 2% annualised on any remaining loans you have there.

That said, since that lending account was for three-year loans at the time, you probably have very few pounds outstanding.

Lenders potentially earning next to nothing on existing loans until repaid

It might be a bit unfair on Lending Works, in my view, but the way the changes have taken place make the situation probably look unfairly alarming for some lenders. Lenders might even be forgiven for thinking Lending Works is making a massive whopper of a lie about the scale of the damage.

I'll try to give an example to explain it:

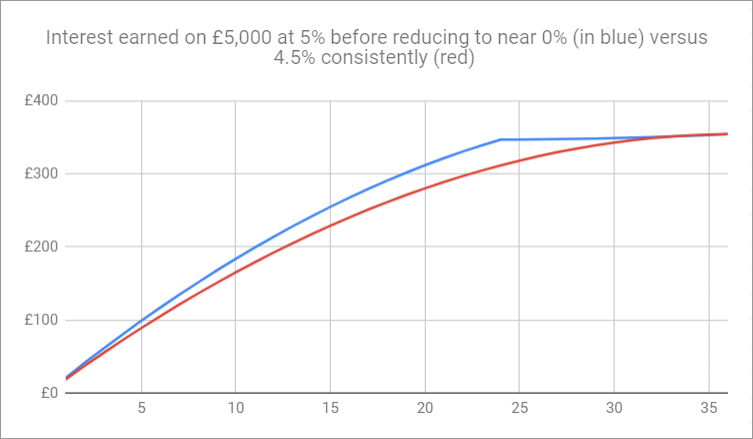

The graph above shows the total interest you would have earned on existing three-year loans if you lent £5,000 at a 4.5% target rate that was never reduced for the full length of the loans (the red curve).

This is contrasted with an example of the situation for a hypothetical Lending Works* lender today (the blue line). The blue line shows earnings that begin at 5%, but then a sudden change to almost zero interest for the last 12 months of the loan repayments. While it's a shock to see the rates flatline two thirds of the way through, notice that the total interest paid at the end is identical in both cases.

In both cases, lenders will earn an annualised rate of 4.5% on the loans made three years ago, and in the same time frame. If you had received the steady returns (the red line) you would probably have been satisfied. You're getting what was advertised after all.

The blue line sort of seems shocking when it flatlines. Active lenders will be looking at their detailed reports in their Lending Works accounts and visualising this flatlining. I hope I've explained it for you.

This is what I've been talking about when I've used the expression “annualised”. The interest the blue lender will earn for 12 months on her remaining older loans will be pitiful from now on. But on an annualised basis, she is expected to earn as much as someone else who earned a slightly lower rate consistently.

Annualised rate in pounds

I'll give you another example of the above using pounds earned, not interest rates. Because annualisation is not a trick of the light. It actually shows itself in the cash that hits your account.

If you were projected to earn £500 in interest on your older loans at the end of three years, that might have come down now to, say, £450. (Again it varies between lenders. This is just an example.)

If you have already earned £425 of that interest in the first 24 months, this means you might now just earn £25 more on those loans.

At first glance, this might look to you to be a 75% reduction in interest. You were expecting another £100 in future, and instead you're just getting £25 more.

But that's misleading. Really, your total interest has just been cut by £50: from £500 to £450. And you'll earn that £450 in the same time frame as someone who had earned a lower but consistent rate from the start.

I think my example here could be quite typical for many lenders. Because, with Lending Works' personal loans, borrowers pay more interest at the beginning while repaying less of their actual loan. Towards the end of the loan, borrowers are repaying more of their loan and paying less interest. It means, on any given loan, your earnings are higher in pound terms at the beginning.

Take a step back, because Lending Works has consistent results

An important point you might be missing is that the spread of results between lenders on an annualised basis is still tight compared to many other peer-to-peer lending companies.

At others, you see that some lenders earn massive losses or massive wins at the extreme ends, even while the average lender – or even most lenders – have satisfactory results in the middle.

Take the ever-sturdy Zopa – another personal loans P2P platform. Zopa has confirmed that up to 1% of lenders have recently been facing small losses. Meanwhile, a similar number are highly likely to have been earning over 11%, based on 4thWay's 5,000 random samples of its historical loans. The typical returns at Zopa have been 4% to 5%.

Many lenders using Lending Works* might now be getting lower typical returns than Zopa on their loans up to 2019. That could be a disappointment, as it was unexpected. But there is a great deal more consistency. The spread between results is smaller, with more than 70% of all lenders earning between 80% and 100% of the expected target lending rates.

Most of the rest are earning more than 70% and just an unlucky few are on target to earn over 60%.

How are lenders holding up?

Lending Works told 4thWay that it's just had 30 enquiries about the changes, including 20 complaints, versus “hundreds” who have said Lending Works is better now than it was before. Lending Works claims that the majority like the changes it's made.

There's no way I can confirm those figures, but certainly Lending Works' changes will mean its online lending platform will be fairer and healthier in future: from loans issued in 2020 and beyond. You can read about that in Is Lending Works Still A Good Investment?.

A post script that I can't resist

There will be other situations that I haven't covered above.

For example, what if you lend money in March 2020, and Lending Works allocates existing loan parts to you that were issued in 2019? This would happen if you lend at the same time that another lender with loan parts from 2019 decides to sell out. In this case, you'll be earning the advertised lending rates for 2020, not the reduced rates of others in 2019.

So, you see, it's just not possible to cover all lenders' situations here!

The other articles in this series are:

Lending Works Update: March 2020 Summary.

Is Lending Works Still A Good Investment?

Lending Works Shield: How The Reserve Fund Has Radically Changed.

Read the Lending Works Review.

Independent opinion: 4thWay will help you to identify your options and narrow down your choices. We suggest what you could do, but we won't tell you what to do or where to lend; the decision is yours. We are responsible for the accuracy and quality of the information we provide, but not for any decision you make based on it. The material is for general information and education purposes only.

We are not financial, legal or tax advisors, which means that we don't offer advice or recommendations based on your circumstances and goals.

The opinions expressed are those of the author(s) and not held by 4thWay. 4thWay is not regulated by ESMA or the FCA. All the specialists and researchers who conduct research and write articles for 4thWay are subject to 4thWay's Editorial Code of Practice. For more, please see 4thWay's terms and conditions.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Lending Works and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.