See why 4thWay now accepts ethical ads.

Important Information on Bondora’s Grading and Interest Rates

Alongside our article on some very interesting changes coming this week at Bondora, the European P2P lending company, and my blog showing my opinions, here's our Q&A with the chief executive officer and founder, Pärtel Tomberg.

If you struggle with any technical or other difficult bits, you can skip to the end for our summary.

Q. I think investors are going to ask how credit scoring and borrower grading can be the same across countries, since some countries will have better information on borrowers than others. Put another way, they might want to know if there's a downward adjustment in scoring in countries where data is more scarce and less trustworthy or where recoveries are less easy.

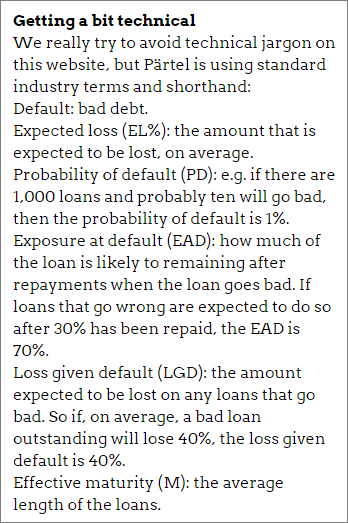

A. a) Good question. Our score is based on the expected loss and  includes 4 components -> EL% = PD*LGD*EAD%*M.

includes 4 components -> EL% = PD*LGD*EAD%*M.

PD (probability of default), LGD (loss given default), EAD (exposure at default) are all country-specific. New countries all have a very high LGD factor as recoveries are only coming in and we do not yet have solid data on what they are actually going to be like.

Therefore we assume, based on our current data, that almost the entire default will be written off in those countries although data from Finland is already showing full recoveries for cohorts that defaulted a year ago.

PD dimension is calculated using local data and local portfolio performance benchmarked with local credit portfolios. Therefore this captures the differences in credit risk in countries and the segment split in countries (e.g. Spain itself might not be risky but there are bigger prorportion of sub-prime borrowers there due to high unemployment and hence you get more applications from these segments).

b) The rating is a combination of these different factors that standardises the market-specific differences into a single score that is easy to understand and already captures all credit-risk differences between the countries.

Q. A very closely related question: you told us that “This price takes into account credit-risk parameters…each per country taking into account the market differences on credit quality and recoveries”. Is it just the price that changes per country or is the grade adjusted based on the same country-specific criteria too?

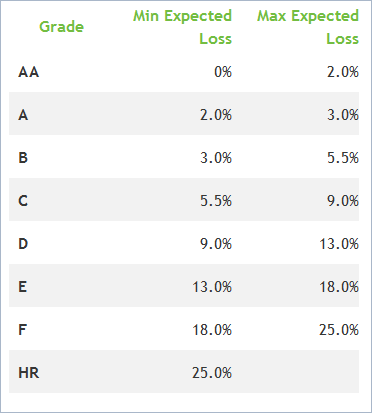

a) Grades are assigned according to the expected loss. Different expected loss ranges make up a grade. Therefore one specific expected loss is always in the same segment regardless of the country.

b) The expected loss is calculated as EL% = PD*LGD*EAD%*M. PD, LGD, EAD are all country-specific. Therefore a borrower with probability of default of 10% might end up with a different EL depending on his/her country as the legal recovery (that drives LGD) will be different.

c) When pricing an EL the country-risk is added on a macro-level so the price is adjusted. Therefore on Expected Loss or Grade can get different prices depending on the borrowers country. These differences however are not that very high (a couple of percentage points max).

Bondora's new European-wide borrower grades and expected bad debts

Source: Bondora

Q. Eight grades is a lot! Will you be showing default forecasts and actual defaults for each grade?

a) Yes, the last grade HR of course is very wide and includes loans with expected losses from 25% to nearly 100%. Investors in sub-prime loans will need to split this into further sub-segments in the future.

Q. Where are you getting your credit-risk parameters from? Is that from your own proprietary data?

a) The risk parameters are based on 3 different data sources:

i. A) Internal data that is available to all investors through the public datasets.

b) And from proprietary sources that cannot be shared with the public:

i. B) External data that we cross-check with other databases (e.g. Equifax).

ii. C) Behavioral data based on actions taken on our website and other Big Data.

Q. I have one more question, if you have time. You said you'd use CAPM + 5% [author's note: that means adding 5% to the interest rate] after working out what rate is needed to neutralise the expected risk. Did you mean *1.05 (so 10% plus 5% of 10% is 10.5%) or did you mean + five percentage points (so 10% becomes 15%)?

a) It means five percentage points. So if CAPM-based efficient price would be 7% then the price will initially be 12%. In the future we’ll create a market mechanism that will drive alpha down or up depending on how much supply there is in one segment HOWEVER we’ll never allow investors to price loans below our CAPM efficient frontier line.

A good starting point

I hope you could follow that. Mostly it shows that what they're doing behind the scenes matches what you'd hope and expect: Bondora is making a borrower grading system for borrowers across Europe that appropriately takes into account local risks and a whole lot of different data sources to establish the risks.

In addition, we have one more take away. In my blog, I already pointed out that how Bondora will set interest rates (using something called CAPM) is quite possibly going to mean that higher-risk borrower grades have lower interest rates than they should and lower-risk borrower grades have higher rates than they should. It's a weakness of CAPM.

Adding five percentage points to the initial interest rate is, in particular, going to have a dramatic impact on safety of the lowest-risk loans. A 7% loan boosted to 12% is a much more dramatic increase than a 25% loan boosted to a 30% rate. Please read my other blog for more: One Borrower Grading System to Rule Them All.

Sources: Bondora

Commission: we don’t receive any commission from any of the P2P lending companies mentioned in this article for publishing their mathematically calculated 4thWay® Risk Ratings and our editorially independent 4thWay® Insight Reports, which are our own proprietary research products to help individual lenders like you make good investment decisions. We do not take commission for including P2P lending companies in our free comparison tables. All P2P lending companies will be included over the next few weeks. This does not affect our editorial independence. Learn How we earn money fairly with your help.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.