To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.

Readers’ Questions: Should I Worry Funding Circle Downgraded Property Loans?

I fielded a call from a lender who wondered, only very mildly worried, about Funding Circle's changes to its property loans, which it announced a short time ago. There are two changes.

Some property loans to get a worse grade

Funding Circle is going to start giving some of its property loans a worse grade.

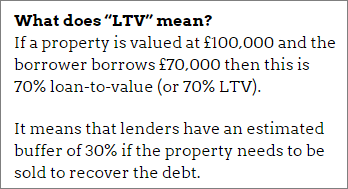

The business and property loans P2P site gives a solid example. Loans it accepts with the highest “loan-to-value” or LTV (see info box, right) could now be given Funding Circle's B grade instead of an A grade.

The business and property loans P2P site gives a solid example. Loans it accepts with the highest “loan-to-value” or LTV (see info box, right) could now be given Funding Circle's B grade instead of an A grade.

Previously, virtually all Funding Circle's property loans were all graded either A+ or A.

Loan-to-value is far from Funding Circle's only criteria. A-grade property loans have sometimes had LTVs better than 50% (lower is better) while A+ grades have had 70%.

The change isn't something to worry about. All it means is that Funding Circle has learned from further research and analysis, looking at the results of its existing loan book, and it is taking the precaution of giving some property loans a lower grade in future to better reflect the risks.

This doesn't affect existing loans, just new ones.

A note about Funding Circle's property LTVs

Just a quick lesson: most Funding Circle property loans are development loans and Funding Circle doesn't quote a loan-to-value based on the current property value. Instead, it is based on the hoped-for sale value after the property development is completed – the so-called “gross development value”.

So in practice development loans are often for more money than the existing land or property is currently worth – and the value could even shrink before it rises in some cases; for example on beginning groundworks only to find the land is not good for building on, or if pre-existing buildings are torn down.

Higher interest rates too

The second change is related to the first. Funding Circle's is going to charge different interest rates on some property loans. Therefore I think we can expect to see higher rates on some of those loans.

So the new grades might help you to better understand when a property loan is higher risk while, at the same time, rewarding you with more interest for that risk.

Does Funding Circle downgrade existing loans?

The above query reminded me of something that some Funding Circle users once complained about a few years ago. Referring to all Funding Circle's loans, not just property loans, they said that Funding Circle routinely changed the grade of loans after the loan had started.

If this was true, it would make a mockery of the grades as well as Funding Circle's statistics on bad debts. After all, it could shunt a load of A+ loans that had gone bad down to C grade and then say how brilliant it is at grading borrowers, because there had been hardly any A+ loans written off.

The usefulness of the grades is clearly only if they get them right to start with.

The good news is that I did a study of some thousands of its loans and found grade changes after the loan was launched to be an absolute rarity. Potentially a bigger (or at least newer) study would show differences, but for the moment I think it's not something to worry about.

Read about development loans lending in

Why Property Development Lending Is Riskier Than Most.

Checklist For Selecting Development Loans.

Our service is free to you. We don't receive commission from the above-mentioned companies. We receive compensation from some other P2P lending companies when you click through from our website and open accounts with them. This doesn't affect our editorial independence. Read How we earn money fairly with your help.