4thWay users prefer our newer format for our reviews into peer-to-peer lending companies. To read about Proplend, read the Proplend Review.

If you would really find it useful to have reports like this, or other detailed reports in another format, please get in touch. We are very interested in how we can present you with all the information you want and need – in the way you want it – to educate yourselves about P2P lending opportunities.

Here's our detailed Proplend review. Last updated on 26th October 2016.

Quick expert summary: fantastically good security

Proplend’s biggest strength is in the security it offers, which is properties that are earning considerably greater rent than the monthly loan payments, and where borrowers are strictly limited on the amount they can borrow compared to the property value.

Lenders in Proplend’s “tranche A” products are protected by property that is valued at more than twice the size of the loan. Borrowers must also make six months of loan interest payments in advance.

Combined with very generous interest rates for the risks involved, we believe the risks are very well contained. Proplend* is highly transparent, sharing the detailed data we need to assess its performance.

We believe that its excellent security requirements and transparency offset the risks of it being a small platform and of its minimum lending amount, which is fairly high at £1,000. Proplend’s key team has plenty of relevant banking experience.

About Proplend's lending products

Proplend has three lending products that are secured against residential or commercial property that is receiving rent, which is intrinsically one of the safest types of loan.

You need to select for yourself which loans to lend in using the details Proplend provides. All loans are interest only for six months to four years:

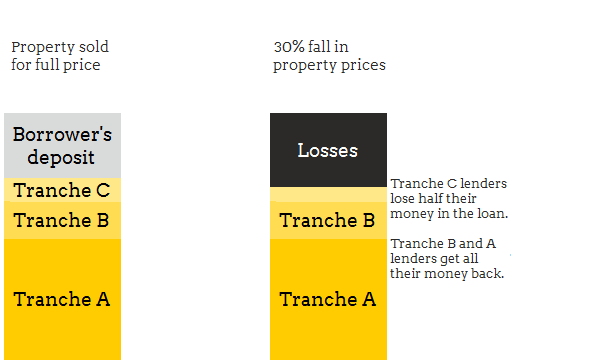

Tranche A: lend up to a maximum of 50% of the value of the property, i.e. if the property is valued at £100,000 then the loan will be for a maximum of £50,000, giving incredibly high protection. In the event the property has to be repossessed and sold, the property price has to fall over 50% after costs before lenders lose any money in that loan.

Tranche B: lend for higher interest than tranche A in the slot between 50% and 65% of the value of the property. The property price has to fall over 35% before tranche B lenders lose any money in that loan. If it falls 40% you lose 1/3 of your money and if it falls 50% you lose all your money in the loan.

Tranche C: lend for even more interest than tranche B in the slot between 65% and 75% of the value of the property. The property price has to fall over 25% before tranche C lenders lose any money in that loan. If its falls 30% you lose half your money and if it falls 35% you lose all your money in the loan.

How Proplend tranches work if a property needs to be repossessed

With all these lending products, you are always first in the queue ahead of other lenders (such as banks) to get your money back in the event the borrower can't pay when Proplend* needs to repossess and sell the properties on your behalf.

Interest rates, PLUS Ratings and Risk Scores

[supsystic-tables id='33']

We combine tranches B and C for the PLUS Rating, because there is not enough history and data to rate these two tranches separately.

Only 6/64 platforms have earned 4thWay PLUS Ratings and Proplend* is one of them.

Only 6/64 platforms have earned 4thWay PLUS Ratings and Proplend* is one of them.

Proplend has been awarded our top rating of five PLUSes for its tranche A product as well as a three PLUSes rating for its tranche B and C products combined.

This means we believe the interest rates (shown in the table above) are high enough for the risks.

Proplend* has achieved these high PLUS Ratings despite being penalised heavily by our rating methodology due to its relatively small history. Currently we expect that its tranche B and C loans will therefore earn even better PLUS Ratings in the future.

Proplend's 4thWay Risk Score of 3/10 for its tranche A product is very low.

Proplend's 4thWay Risk Score of 3/10 for its tranche A product is very low.

It shows that we believe losses before interest in a terrible recession and combined property crash with distressed property sale prices of 55% would be limited to less than 2.5% before interest earned.

Proplend's risk score of 7/10 for its tranche B and C product combined is above average – although again we have added large temporary penalties due to the relatively small history.

It means that average losses could be up to 20% during a serious recession and property crash. It could take up to 4 years to recover those losses.

The PLUS Ratings and Risk Scores are indicators, not guarantees. Read more disclaimers here.

Key data points

[supsystic-tables id='35']Proplend review: team and processes

The team includes two core people with 35 years' experience in assessing the types of loans that Proplend does and managing lending risks. Two other directors have decades of relevant or somewhat relevant experience.

Proplend focuses on agreeing loans where the property values are significantly higher than the loan, giving large downside protection to lenders in the event the loan goes bad.

We would ideally like to see Proplend consider the quality and experience of the borrowers themselves in more detail. However, this is a minor point considering Proplend will only accept loans if the property is receiving rent that is 1.25 times more than the monthly loan payment.

Proplend does credit and fraud checks – an absolute must. Properties are always inspected and professionally valued.

For the type of lending Proplend* arranges, we are very satisfied with these processes.

Bad debts

Proplend has had no bad debts and no late payments since it started in 2014.

Its loan book is still small with less than a dozen loans. It is only due to the intrinsically low-risk nature of the type of lending that Proplend does, combined with its people and processes, that we are able to confidently estimate bad debts in tough economic times when Proplend has completed more loans. For most other types of lending we would, at this stage, say “insufficient data”.

Exiting loans early

To get your money back before a loan is due for repayment, you can sell your Proplend loans to other individual lenders on Proplend's secondary market. Proplend charges a 0.5% fee for this.

You might sell your loan parts for more or less than you paid.

As with any investment, it might not be possible to sell your loan parts early or as swiftly as you want, particularly during recessions or other times when far more lenders want to sell than buy. Or you might have to sell your loan parts for less than you paid to exit early.

On the flipside, during good times you might be able to sell your loan parts for more than you paid, making a profit.

Ease of lending

The loans are all interest only. This means borrowers pay interest each month but don't repay any part of the actual loan until the end. This makes it easier to lend, because you do not need to re-lend loan repayments every month to keep earning full interest.

Proplend has no automated options to make lending your money easier. You need to choose loans for yourself using the details provided about each borrower, the property and the interest rates.

When monthly interest payments are made to your account, you can withdraw them to lend elsewhere. And you probably will have to, because the minimum you can lend again is £1,000. Most of us won't earn that much interest in one month.

As a result, Proplend* is particularly suited to lenders who want to use the monthly interest to supplement their other income.

Diversification

With few available loans and a minimum £1,000 lending amount, it's not possible to spread your money – and therefore risk – across lots of loans on Proplend. However, the very low intrinsic risk in these kinds of loans means lenders need far less diversification.

Lenders should always be diversifying across five or more P2P lending websites.

Deal-making potential

Since you can select individual borrowers and buy and sell loan parts on a secondary market, there might be opportunities to make bigger gains through selective loan selection and horse trading. However, the low risk nature of these kinds of loans means we do not expect you to see many opportunities for outlandish gains.

Technology

Proplend* uses secure authentication both before and after you log in to your online account. This is a basic, vital safety feature that a surprising number of websites overlook.

Your cash is held securely at a client account in Barclays.

Transparency

Proplend does a great job of providing a lot of information to the public and very detailed information to 4thWay. It is constantly improving and adding to the information available, which is very reassuring.

It is one of the most transparent investments we have ever come across in any industry.

Skin in the game

The directors and Proplend itself do not promise to lend alongside you. This means that their incentives are not as closely aligned with your own as you should like.

However, this is true of virtually all investments.

If Proplend goes bust

If Proplend goes bust

Proplend* is regulated by the UK's Financial Conduct Authority.

It has set up an independent trustee to run down your loans in an orderly fashion if it goes out of business. Plus, since it is regulated, it must set aside £20,000 to help fund the trustee.

It also has a “security trustee”, which holds onto the properties that borrowers use to secure their loans.

As with all investments, your loans are not protected by the government through the Financial Services Compensation Scheme (FSCS).

When your money is not on loan, it is held in a separate Barclays account. The first £85,000 of your money in Barclays accounts (or potentially across other banks within the Barclays group) is protected by the FSCS in the event that Barclays fails.

Financial health

Proplend, like most P2P lending websites, is still not profitable. However, it just raised £1.2 million. This will likely provide Proplend* with necessary cash to keep growing and it adds reassurance from a fund that should be highly knowledgeable about this industry.

At this stage, we believe Proplend is a going concern that can grow further without taking dangerous risks.

Accuracy

There’s always the risk, for all companies, that their information is inaccurate. And we can never be sure that a company is fault or fraud free. However, we have seen no signs to indicate significant errors in Proplend's numbers or statements.

Costs

We estimate that your costs as a lender are around 2.5% per year, which is low to fair for these loans.

This is based on our estimate of the spread between what borrowers pay, including fees, and what lenders receive.

Important!

- We do not provide personal financial advice and no opinions expressed on or through this website are to be taken as personal financial advice.

- While we try to be as accurate as possible, we can accept no responsibility for any direct or indirect losses if any information on this website proves to be incorrect.

- It is a big challenge rating investments accurately, not least because we rely on data and information from P2P lending companies and others. That's why, while the 4thWay® PLUS Ratings and Risk Scores are objective measures that we are proud of and are working to improve all the time, they are not infallible.

- There are always additional outside risks that most of us just aren’t rich enough to plan properly for. Crazy as it sounds, maybe there’ll be a nuclear war, anarchy or some other big disaster. We can’t measure such risks, nor can we say whether having your money in a savings account would have been any safer.

See our full terms and conditions of use.

*Commission, fees and impartial research: our service is free to you. 4thWay shows dozens of P2P lending accounts in our accurate comparison tables and we add new ones as they make it through our listing process. We receive compensation from Proplend and other P2P lending companies not mentioned above either when you click through from our website and open accounts with them, or to cover the costs of conducting our calculated stress tests and ratings assessments. We vigorously ensure that this doesn't affect our editorial independence. Read How we earn money fairly with your help.

To get the best lending results, compare all P2P lending and IFISA providers that have gone through 4thWay’s rigorous assessments.